Advertisement

Advertisement

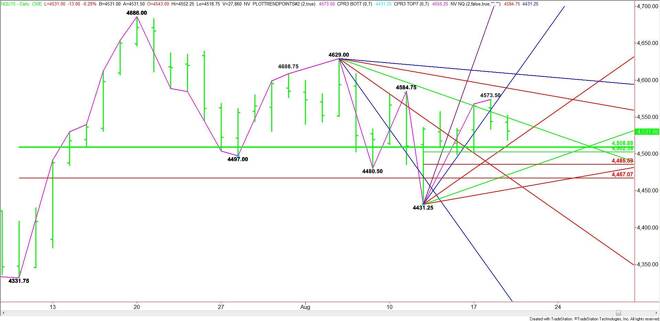

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – August 19, 2015 Forecast

By:

September E-mini NASDAQ-100 Index futures are trading lower shortly before the cash market opening and after the release of the U.S. consumer inflation

September E-mini NASDAQ-100 Index futures are trading lower shortly before the cash market opening and after the release of the U.S. consumer inflation report. U.S. CPI was reported at 0.1%. This was below the 0.2% forecast. The focus now shifts to the latest Fed minutes, due to be released at 2:00 p.m. ET.

Technically, the main trend is down according to the daily swing chart. The main range is 4331.75 to 4686.00. Its 50% level at 4508.75 is a major downside target. The short-term range is 4431.25 to 4573.50. Its retracement zone at 4502.25 to 4485.50 is the next downside target, followed by the major Fibonacci level at 4467.00.

The first uptrending support angle comes in at 4511.25. The next two angles come in at 4471.50 and 4451.25. The latter is the last major angle before the 4431.25 main bottom.

The first support cluster is 4511.25 to 4508.75. The second support cluster comes in at 4471.50 to 4467.00.

A sustained move over 4511.25 will signal the presence of buyers. The first upside objective is a downtrending angle at 4549.00. This is followed by a minor top at 4573.50 and a downtrending angle at 4589.00. The last angle before the 4629.00 main top comes in at 4609.00.

A trade through 4584.75 will turn the main trend to up.

Watch the price action and read the order flow at 4511.50 to 4508.75. This will tell us whether the bulls or the bears are in control.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement