Advertisement

Advertisement

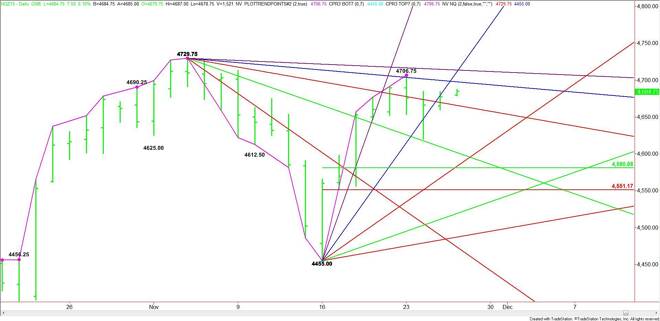

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – November 26, 2015 Forecast

By:

December E-mini NASDAQ-100 Index futures eked out a small gain on Wednesday. Today is a U.S. bank holiday and the cash market is closed so trading will be

December E-mini NASDAQ-100 Index futures eked out a small gain on Wednesday. Today is a U.S. bank holiday and the cash market is closed so trading will be limited to a shortened electronic trading session. This could cause below average volatility and volume.

The main trend is up according to the daily swing chart, however, momentum shifted a little to the downside earlier in the week with the formation of a closing price reversal top at 4706.75.

Based on the close at 4677.25, the direction of the market is likely to be determined by trader reaction to the downtrending angle at 4665.75.

A sustained move over 4665.75 will indicate the presence of buyers. This could create enough upside momentum to challenge the nearest resistance angle at 4697.75.

Overtaking 4697.75 will likely lead to a test of the reversal top at 4706.75. Taking out this level will negate the chart pattern and likely lead to a test of another downtrending angle at 4713.75. This is the last potential resistance angle before the 4729.75 main top.

Overtaking and sustaining a move over the steep uptrending angle at 4711.00 will also indicate the presence of buyers and that momentum is shifting back to the upside.

A sustained move under 4665.75 will signal the presence of sellers. The daily chart indicates there is plenty of room to the downside if sellers come in with big volume. The first downside target is an uptrending angle at 4583.00. If the selling is strong enough then we could see a test of the retracement zone at 4580.75 to 4551.00 over the near-term.

Watch the price action and read the order flow at 4775.75. This will tell us whether the bulls or the bears are in control. Keep in mind that today is a U.S. holiday so volatility plays may not work because of the expected light volume.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement