Advertisement

Advertisement

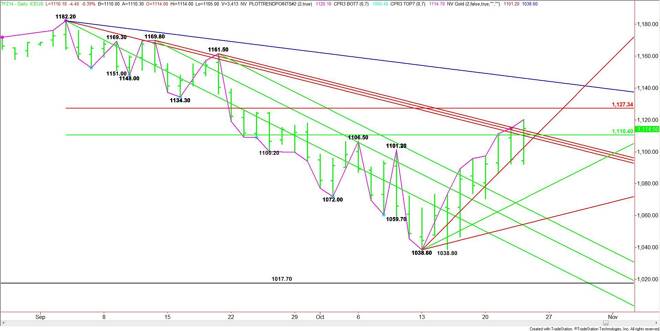

E-mini Russell 2000 Index (TF) Futures Technical Analysis – October 24, 2014 Forecast

By:

After failing to follow-through to the downside, following Wednesday’s potentially bearish closing price reversal top, December E-mini Russell 2000 Index

After failing to follow-through to the downside, following Wednesday’s potentially bearish closing price reversal top, December E-mini Russell 2000 Index futures rallied sharply higher. The upside momentum was strong enough to crossover to the bullish side of three downtrending angles, giving the index an upside bias today.

From the bottom up, support comes in at 1110.40 and 1110.60.

The three downtrending angles drop in at 1108.20, 1109.80 and 1111.50. These angles aren’t necessarily support. However, crossing to the bearish side of the angles will indicate weakness.

Holding above support today should give the index enough momentum to challenge the next upside target at 1127.30. This is the Fibonacci level of the 1182.20 to 1038.60 range.

A sustained move through 1127.30 could lead to further upside action with the next target angle dropping in at 1145.20.

The tone of the market today is likely to be determined by trader reaction to the major 50% level at 1110.40.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement