Advertisement

Advertisement

E-mini Russell 2000 Index (TF) Futures Technical Analysis – October 3, 2014 Forecast

By:

The December E-mini Russell 2000 Index futures contract traded lower early in the session on Thursday, however, buyers came in at 1072.00, slightly above

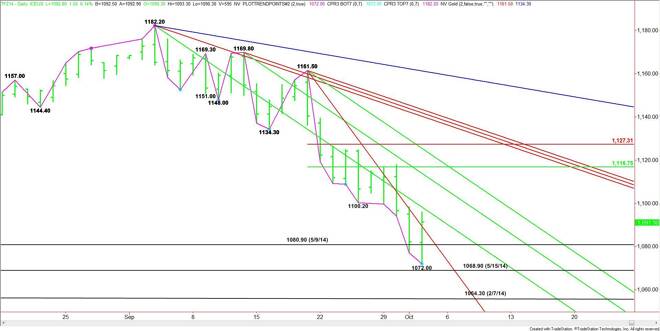

The December E-mini Russell 2000 Index futures contract traded lower early in the session on Thursday, however, buyers came in at 1072.00, slightly above the May 15 bottom at 1068.90. The subsequent rally produced a potentially bullish closing price reversal bottom on the daily chart.

Although not an indication of a change in trend, the closing price reversal bottom often triggers a 2 to 3 rally into the retracement zone formed by the last break. Given the main range of 1161.50 to 1072.00, traders should watch for a rally into 1116.80 to 1127.30 over the next several days.

Because of the numerous lower tops, the index is going to have to chew through these two angles before it can reach the first retracement level at 1116.75. Another angle passes through the retracement zone at 1121.50.

A failure to follow-through to the upside, or a break back under a steep downtrending angle at 1081.50 will be signs of selling pressure. This could lead to tests of 1080.90, 1072.00 and 1068.90. A break under this last level should trigger a move to 1064.30.

If 1064.30 fails then the long-term sentiment will turn bearish since this price is the low for the year.

The tone of the market is likely to be determined by trader reaction to 1095.80.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement