Advertisement

Advertisement

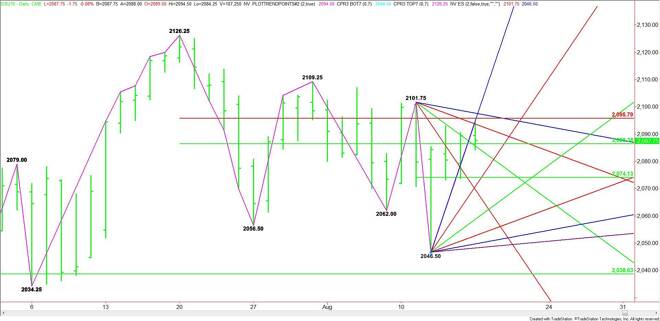

E-mini S&P 500 Index (ES) Futures Technical Analysis – August 17, 2015 Forecast

By:

September E-mini S&P 500 Index futures are called slightly lower based on the pre-market trade. The main trend is down according to the daily swing

September E-mini S&P 500 Index futures are called slightly lower based on the pre-market trade. The main trend is down according to the daily swing chart, but the recent price action has put the market in a position to challenge the nearest main top at 2101.75. A trade through this level will turn the main trend to up on the daily chart.

During the pre-market session, the index stopped at a resistance cluster formed by a downtrending angle at 2093.75 and an uptrending angle at 2094.50. The next resistance targets over this area are 2095.75 and 2097.75.

The daily chart opens up to the upside over 2097.75 with the next target the main top at 2101.75. Besides changing the main trend to up, a trade through this price could trigger a surge into the next main top at 2109.25.

On the downside, the first support area is a 50% level at 2086.25 and a downtrending angle at 2085.75. Crossing to the weak side of this area could trigger an acceleration to the downside with the next major target a short-term 50% level at 2074.00 and an uptrending angle at 2069.75.

Based on the current price at 2087.75, the direction of the index the rest of the session is likely to be determined by trader reaction to 2086.25.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement