Advertisement

Advertisement

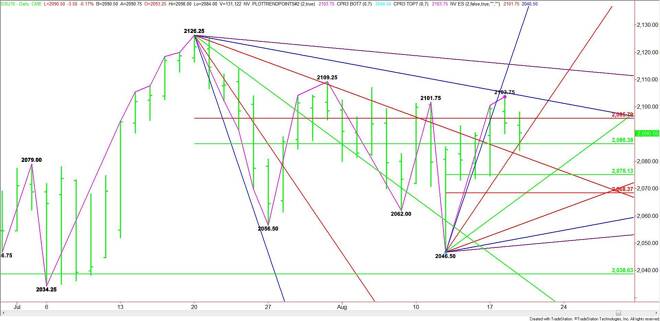

E-mini S&P 500 Index (ES) Futures Technical Analysis – August 19, 2015 Forecast

By:

September E-mini S&P 500 Index futures are trading lower shortly before the cash market opening. The market is currently resting inside a major

September E-mini S&P 500 Index futures are trading lower shortly before the cash market opening. The market is currently resting inside a major retracement zone at 2086.50 to 2095.75. Traders are waiting for the release of the U.S. consumer inflation report due out at 8:30 a.m. ET.

On the downside, the first target is a support cluster at 2086.50 to 2086.25. Holding this area will signal the presence of buyers. This could trigger a move into the Fibonacci level at 2095.75. This level is also a trigger point for an acceleration to the upside with the next targets a closing price reversal top at 2103.75 and a downtrending angle at 2104.25.

The angle at 2104.25 is also a trigger point for an upside breakout with the next target 2115.25. This is the last angle before the 2126.25 main top.

A failure to hold 2086.25 will signal the presence of sellers. Crossing to the weak side of a downtrending angle at 2082.25 will signal that the selling is getting stronger.

The first major target under 2082.25 is a 50% level at 2075.00. This is followed by a Fibonacci level at 2068.25 and an uptrending angle at 2066.50.

The angle at 2066.50 is also a trigger point with potential targets at 2056.50 and 2051.50. The latter is the last potential support before the 2046.50 main bottom.

Watch the price action and read the order flow at 2086.50 to 2086.25 today. This will tell us whether the bulls or the bears are in control.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement