Advertisement

Advertisement

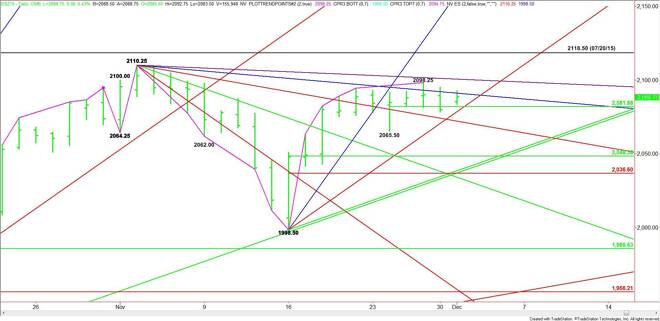

E-mini S&P 500 Index (ES) Futures Technical Analysis – December 1, 2015 Forecast

By:

December E-mini S&P 500 Index futures are trading slightly better shortly before the cash market opening. The market is trading inside yesterday’s

December E-mini S&P 500 Index futures are trading slightly better shortly before the cash market opening. The market is trading inside yesterday’s range, suggesting impending volatility.

The short-term range is 2065.50 to 2098.25. Its retracement zone is 2081.75. Trader reaction to this pivot price will determine the tone of the market today.

A sustained move over 2081.75 will indicate the presence of buyers. The first upside target is a downtrending angle at 2091.75. This is followed by a minor high at 2098.25 and another downtrending angle at 2100.75. The latter is the last potential resistance angle before the 2110.25 main top.

A breakout over 2110.25 will signal a resumption of the uptrend. This may create enough upside momentum to challenge the July 20 main top at 2118.50.

A sustained move under 2081.75 will signal the presence of sellers. This could trigger a fast break into the steep uptrending angle at 2078.50. This is an important angle because it has provided guidance and direction for 10 trading sessions. This makes it a trigger point for a steep break down with 2072.25 the next major target.

The angle at 2072.25 is also a trigger point for an acceleration to the downside with the next major target a short-term 50% level at 2048.25.

Based on the current price at 2087.00, look for a bullish tone to develop on a sustained move over 2091.75 and a bearish tone to develop on a sustained move under 2081.75.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement