Advertisement

Advertisement

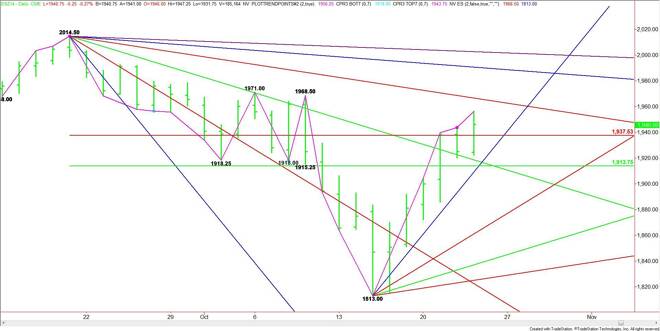

E-mini S&P 500 Index (ES) Futures Technical Analysis – October 24, 2014, Forecast

By:

December E-mini S&P 500 Index futures closed higher on Thursday and on the bullish side of a key Fibonacci level at 1927.50. This gives the market an

December E-mini S&P 500 Index futures closed higher on Thursday and on the bullish side of a key Fibonacci level at 1927.50. This gives the market an upside bias today.

The first support is the 61.8% level at $1937.50, followed by a steep uptrending angle at 1925.00 and a major 50% level at 1913.75. The daily chart opens up to the downside if 1913.75 is taken out with conviction.

The first upside target today is a downtrending angle at 1964.50. This is followed by a pair of main tops at 1968.50 and 1971.00. Taking out these tops will turn the main trend to up on the daily chart. This could help create enough upside momentum to make a run at the next angle at 1989.50.

Look for a bullish tone as long as 1937.50 holds.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement