Advertisement

Advertisement

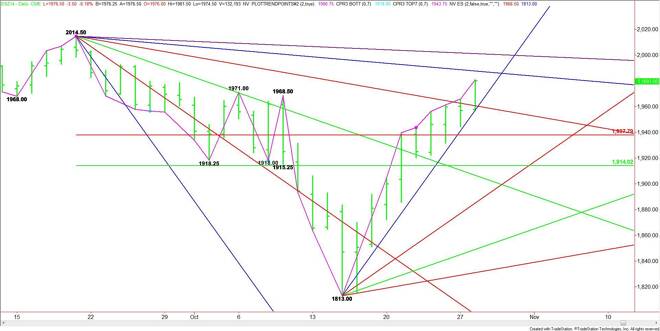

E-mini S&P 500 Index (ES) Futures Technical Analysis – October 29, 2014, Forecast

By:

December E-mini S&P 500 Index futures closed on its high and in a position to continue its strong rally today. Volatility and volume may be down early

December E-mini S&P 500 Index futures closed on its high and in a position to continue its strong rally today. Volatility and volume may be down early in the session if investors decide to sit on the sidelines ahead of the U.S. Federal Reserve Monetary Policy announcement at 2:00 pm EDT. However, volatility should be expected after the statement is released.

Theoretically, a dovish statement should be bullish for stocks, but no one is certain how much of this has already been baked into the market. Because of the strong nine session rally, this could turn out to be a “buy the rumor, sell the fact” situation. Technically, the market is in the window of time for a closing price reversal top so don’t be surprised if the market rallies early then closes lower at the end of the day.

The nearest support is a steep uptrending angle moving at a pace of 16 points per day from the 1813.00 bottom. This angle comes in at 1973.00 today. Breaking this angle will be a sign of weakness, but a move back under 1958.50 will indicate the selling pressure is strong. This could lead to a test of 1937.75 over the near-term.

Holding 1973.00 will be a sign that buyers are still in control. This could lead to a test of 1986.50 early in the session. This is followed by another angle at 2000.50. This is the last angle before the all-time high at 2014.50.

The tone of the market today will be determined by whether investors can hold the index above 1973.00.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement