Advertisement

Advertisement

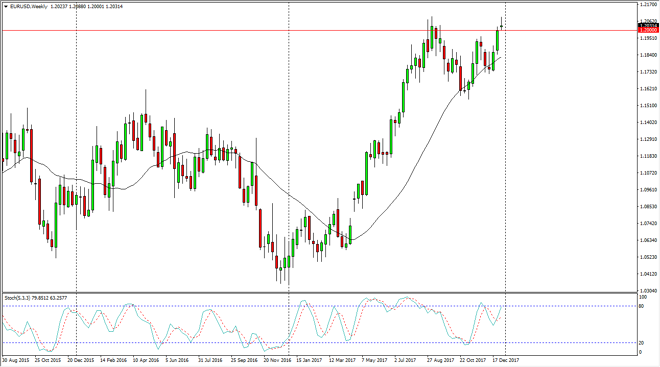

EUR/USD forecast for the week of January 8, 2018, Technical Analysis

Updated: Jan 6, 2018, 05:54 GMT+00:00

The EUR/USD pair has been volatile during the week, showing signs of strength, but as we start to wind down the Friday session, we have formed a shooting star.

The EUR/USD pair broke above the 1.20 level during the week, rallied a bit, and have now pulled back to form a bit of a shooting star. However, since we are sitting on top of the 1.20 level, I think that buyers will return given enough time. Ultimately, I believe that the market will break out to the upside, perhaps clearing the 1.21 handle. Once we clear the 1.21 handle, the market is free to go much higher. The weekly chart has recently broken above the top of a bullish flag, and that suggests that we are going to go to the 1.32 level. I don’t have any interest in shorting this market regardless, and if we pull back far enough, I think there will be plenty of value hunters coming back into the marketplace, especially near the 1.19 and 1.18 handle.

I believe that there is a lot of noise in the marketplace and of course high-frequency traders have a lot of influence in this pair, but I also recognize that ultimately this is a market that does favor the upside, as the European Union looks likely to taper quantitative easing, and as the market already knows that the Federal Reserve is looking to raise interest rates 3 times in the next year, there’s not much in the way of a surprise there. I believe given enough time, we will go looking towards the 1.24 handle, the 1.25 handle, and eventually the 1.32 level. That’s a longer-term call of course, but for investors the upside looks promising.

EUR/USD Video 08.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement