Advertisement

Advertisement

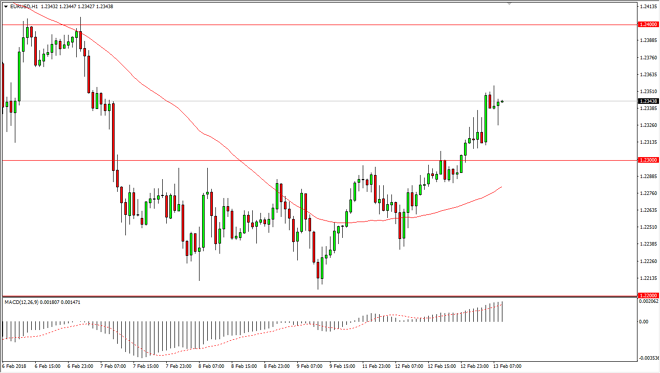

EUR/USD Price Forecast February 14, 2018, Technical Analysis

Updated: Feb 14, 2018, 05:36 GMT+00:00

The EUR/USD pair has gone higher during the trading session on Tuesday, breaking above the 1.23 handle again. There is a certain amount of bullish pressure underneath, and I think that were going to go looking towards that level rather soon, and I think that we will continue to see the US dollar soften in general.

The EUR/USD pair broke higher during trading on Tuesday, breaking above the 1.23 handle. There’s a lot of noise in this area, but I think that the 1.23 level should offer support as it was resistance previously. I would say the same thing is probably to be expected at the 1.24 handle as well. We have pulled back rather recently, after initially trying to go to the 1.25 handle. That’s an area that will be more resistive, because it is a large, round, psychologically significant level.

Once we get above the 1.25 level, it’s likely that the market becomes more of a buy-and-hold situation, or perhaps even an opportunity to buy on the dips, building a larger position. When I look at the longer-term charts, there is a bullish flag that has been broken to the upside, and it should be measured as a potential moved to the 1.32 handle. That being said, it’s going to be difficult to get there, because there’s a lot of potential noisy areas between here and there. I believe that the grind higher should give you plenty of opportunity, and you should be looking at any time this market pulls back as an opportunity to pick up value. Think of the pair is going on sale when this happens, as breaking above the 1.21 level recently was a major breakout. It’s not until we break down below there that I would be concerned about the overall uptrend.

EUR/USD Forecast Video 14.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement