Advertisement

Advertisement

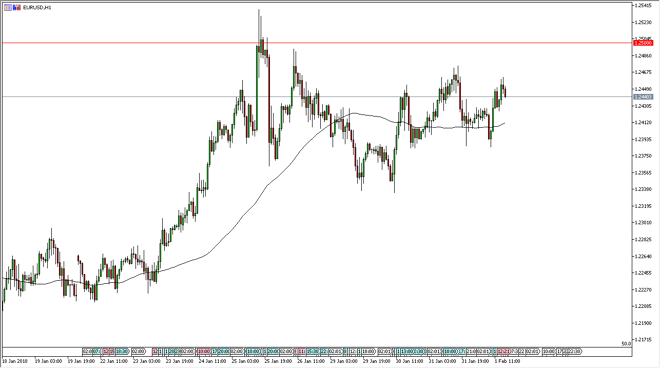

EUR/USD Price Forecast February 2, 2018, Technical Analysis

Updated: Feb 2, 2018, 04:47 GMT+00:00

The EUR/USD pair initially tried to fall during the trading session on Thursday but found enough support near the 1.24 level to bounce again as it looks likely to sit still until we get the jobs number.

The EUR continues to show volatility and a longer-term strength, as we have bounced yet again during the trading session on Thursday. We await the jobs number coming out of the United States, so that of course will have a massive influence on where this market goes next, and I believe that the 1.25 level above being broken to the upside would be a very strong signal to go much higher. Alternately, we could break down below the 1.24 level after the number, but I think there’s plenty of support underneath to keep this market going higher and I would look at any type of breakdown would probably offer a value proposition if you are patient enough to find support.

This market will be very noisy after the jobs number, but historically the jobs number has caused nothing but noise, and very rarely a significant move longer term. By the time everything has settled down, it’s quite common to see the overall trend continue, meaning that we could get a lot of noise, only to sit still at the end of the day, only to find buyers sometime next week. Because of this, I have no interest in shorting this market, and I think that it is either a “buy on the dips” situation, or it is a situation where you buy fresh, new highs. Otherwise, there’s not much to do until we get a signal. I believe that the weakness in the US dollar will continue throughout the rest of the year, so being patient and simply taking the trade as it appears is the way to go.

EURUSD analysis Video 02.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement