Advertisement

Advertisement

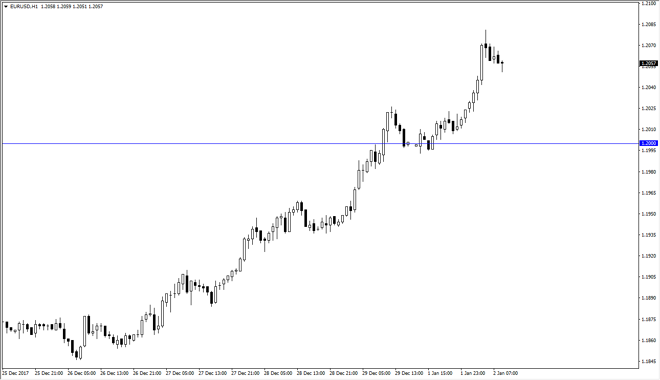

EUR/USD Price Forecast January 3, 2018, Technical Analysis

Updated: Jan 3, 2018, 07:08 GMT+00:00

The EUR/USD pair spiked initially during the trading session on Tuesday, but pulled back a bit as the market calm down. The 1.20 level underneath should be the “floor” in the market, as we await the jobs number coming out of America later this week. I believe that given enough time, the buyers should continue to go much higher.

The EUR/USD pair initially tried to rally during the trading session on Tuesday, but we did pull back a little bit. Ultimately, I believe that the buyers will continue to go higher, with the 1.20 level offering the “floor” in the market. Longer-term, we need to reach towards the 1.21 handle above, which is massive resistance. A break above that level then sends this into a “buy-and-hold” scenario. Ultimately, I believe that will happen, but being patient is going to be very much necessary between now and that move.

If we were to break down below the 1.20 level, the market could go much lower, but in the meantime, I think it’s very unlikely. The 1.19 level underneath should continue to be supportive as well, but given enough time I think that no matter what happens, the buyers will return. I believe that this pair could go much higher during the year, and that we are just now starting to see buyers flex their muscles. If we did manage to break down below the 1.19 level, the market should go to the 1.17 level after that. That being the case, I think it would add a lot of confusion to what I see as a potential strong move to the upside just waiting to happen. The volatility may pick up occasionally, but those who are patient and keep their trading position small, you should be able to benefit from what I see as a breakout above the bullish flag on the weekly chart.

EUR USD Forecast Video 03.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement