Advertisement

Advertisement

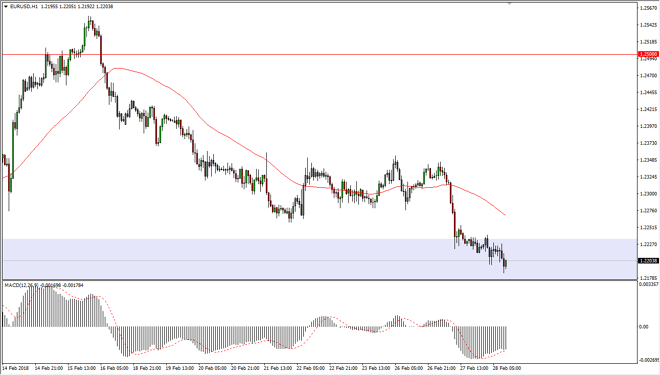

EUR/USD Price Forecast March 1, 2018, Technical Analysis

Updated: Mar 1, 2018, 06:20 GMT+00:00

The EUR/USD pair fell on Wednesday, as we continue to drift a bit lower in favor of the US dollar. Higher interest rates and the treasury markets continue to push the greenback higher, but overall, I think there is plenty of support underneath to turn things around eventually.

The EUR/USD pair has drifted a bit lower during the trading session on Wednesday, breaking down below the 1.2250 level, and reaching towards the 1.22 handle. There is a significant amount of support down to the 1.21 handle, which was previous resistance, and the scene of a major breakout. Because of this, I’m waiting for an opportunity to go long of this market, as I believe that not only does the 1.21 level offer significant support, but so does the longer-term uptrend line below there, so I think it’s only a matter of time before the buyers get involved. I’m waiting for some type of daily supportive candle, or a hammer, something like that to get involved.

I think that the market will then go looking towards the 1.25 handle, which has been massive resistance. If we can break above there, then I think we continue to go higher, reaching towards the 1.32 level longer term. Alternately, if we were to turn around and break down below the 1.20 level, the uptrend is over, and we should continue to go much lower, as it would be a major breakdown of support. Ultimately, I think that the next couple of sessions will be crucial, and that will tell is where were going to go longer term. With this type of action, I think if you are patient enough, we will get some type of impulsivity that tells you which way to trade, and you can simply hang on for the next several handles.

Euro to Dollar Forecast Video 01.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement