Advertisement

Advertisement

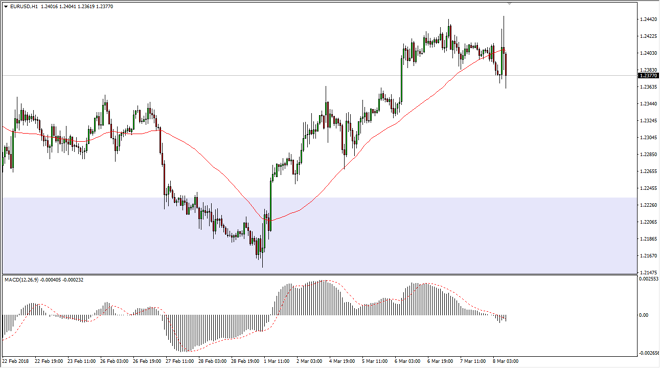

EUR/USD Price Forecast March 9, 2018, Technical Analysis

Updated: Mar 9, 2018, 06:28 GMT+00:00

The EUR/USD pair has been very noisy during the trading session on Thursday, as the ECB gave its press conference. There seems to be a lot of confusion around the messaging, and this of course shakes a lot of people out of the uptrend.

The ECB had a press conference during Thursday trading session that through the market into disarray. Initially, it suggested that perhaps inflation was building, and that had people buying the EUR. However, this was later contradicted by a statement suggesting that stimulus easing was still necessary to stoke inflation. Because of this, the market has been very noisy as I record this, looking very likely to roll over a little bit. However, I still believe in the longer-term uptrend, but we may have to pull back to find a bit of value first. Because of this, I am not shorting this pair, I am looking for some type of support near the 1.23 level, or perhaps even lower.

It’s not until we break down below the 1.21 level that I feel this market is in serious trouble. Perhaps this is a significant attempt to try and take advantage of value hunting in the short term, so keep that in mind. I think stepping away from the volatility is probably the best way to approach this market in the short term, but I believe that some type of daily supportive candle will present itself that we can start buying. If we were to break down below the 1.21 handle, the market could unwind rather rapidly. That of course would be a catastrophic move and could send a lot of selling pressure into this market. On the other hand, if we were to break above the 1.25 handle, the market should continue to go much higher.

EURUSD analysis Video 09.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement