Advertisement

Advertisement

EUR/USD Price forecast for the week of February 12, 2018, Technical Analysis

Updated: Feb 10, 2018, 06:02 GMT+00:00

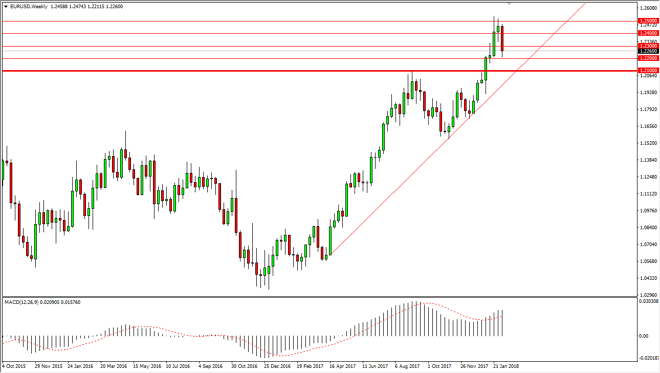

The EUR/USD pair had a rough go of it during the week, dropping 3 handles. We did find support at the 1.22 level, which is an area that I think begins significant support. Even if we do drop from here, we have a way to go before I think the uptrend would be in trouble.

When I look at the weekly chart, as plain as the nose on my face I see that there was a bullish flag that has been broken to the upside. That flag measures for a move the 1.32, and I find it typically these moves eventually become true. The 1.21 level has previously been massive resistance, in the form of a couple of shooting stars. I think that we may go back towards that area to retest for support, and I fully anticipate that we are going to see it. Not only is the 1.21 level supportive based upon previous price action, but we now have an uptrend line in that general vicinity that looks to be holding up the market as well. For the longer-term trader, these are the kinds of dips that investors look towards, as it gives them an opportunity to pick up the asset “on the cheap.” Essentially, the Euro is on sale.

If we broke down below the uptrend line, which of sensibly is the 1.20 level, then I think the uptrend could be in trouble. One thing worth paying attention to is that we do have divergence on the MACD, which is a very sign. However, that typically meets pullback, not necessarily melt down. Because of this, I think we may see a bit more negativity, but in the end, I would anticipate that buyers will be attracted to this market relatively soon.

EUR USD Forecast Video 12.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement