Advertisement

Advertisement

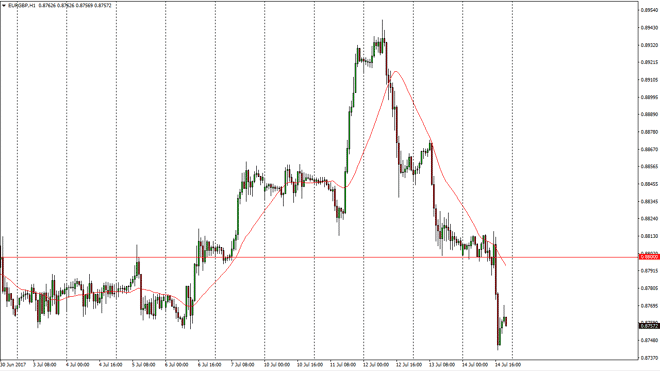

EUR/GBP Forecast July 17, 2017, Technical Analysis

Updated: Jul 15, 2017, 07:11 GMT+00:00

The EUR/GBP pair went sideways initially during the day on Friday, but then sliced through the 0.88 level as the British pound broke out against the US

The EUR/GBP pair went sideways initially during the day on Friday, but then sliced through the 0.88 level as the British pound broke out against the US dollar. Currently, looks as if the market is ready to continue going lower and the weekly candle is a bit of a shooting star. Because of this, I think that we will continue to see sellers in this market as we reenter the previous consolidation area that has been a mainstay of this market for several months. Given enough time, we could go as low as the 0.2 level but I think there is going to be a lot of noise and volatility in this market due to headlines coming out of the negotiations between Great Britain and the European Union.

Selling rallies

I believe in selling rallies, but I also believe that your position size might need to be a bit smaller than usual, because of the volatility that could find itself creeping into the market due to the headlines. Ultimately, I believe that this market will have to break above the 0.8825 level to offer the comfort to start buying. I believe that the market will continue to drop from here, and every time that the market show signs of weakness, sellers will get very aggressive in favor the British pound. This market continues to fall in my estimation, as the British pound has suddenly become a much more attractive currency to Forex traders around the world.

EUR/GBP Video 17.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement