Advertisement

Advertisement

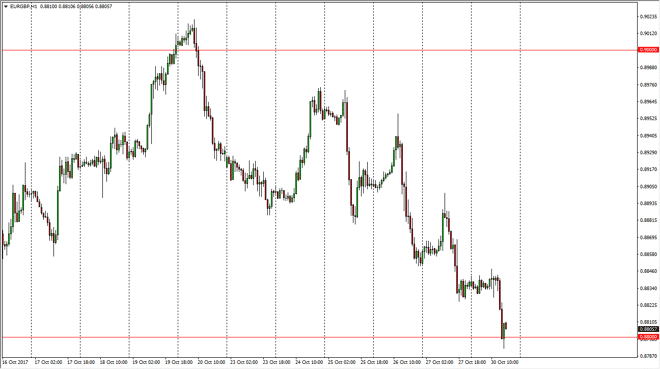

EUR/GBP Forecast October 31, 2017, Technical Analysis

Updated: Oct 31, 2017, 05:21 GMT+00:00

The EUR/GBP pair went sideways initially during the trading session on Monday, testing the 0.88 level underneath. I believe that the area continues to be

The EUR/GBP pair went sideways initially during the trading session on Monday, testing the 0.88 level underneath. I believe that the area continues to be very important for the longer-term, as it has been supportive and resistive more than once. The market should continue to see significant volatility, mainly due to the European Central Bank being so soft, but at the same time I believe that longer-term concerns about what the UK does next is probably going to continue to offer a bit of support. It isn’t so much that I like buying the Euro, it’s more like it’s structural support that will take a significant amount of pressure to break down below. However, if we did breakdown below there, the market could unwind and reach towards the 0.86 level. That’s an area that’s also been important, and that of course we have the psychologically important 0.85 level underneath there.

The choppiness in this market can be a bit much to take at times, because the economies are so intertwined. Also, the overall move is generally going to be slower, as it is double the value of most other currency pairs per tick. That of course leads to much more leverage if you’re not careful, but it also allows you to make strong profits if you can hang on to the trade. Overall, I believe that the market is probably going to try to break out to the upside, and if we can clear the 0.8850 level, it is only a matter of time before we continue to the upside. The choppiness continues to be very difficult to deal with for a lot of traders, but quite frankly I believe that the longer-term uptrend is still somewhat intact. Volatility continues to be a major issue.

EUR/GBP Video 31.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement