Advertisement

Advertisement

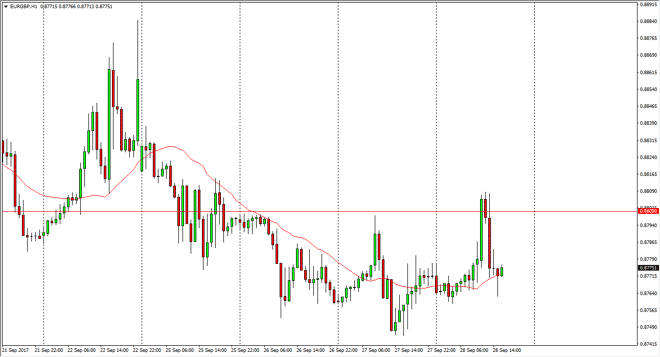

EUR/GBP Forecast September 29, 2017, Technical Analysis

Updated: Sep 29, 2017, 05:43 GMT+00:00

The EUR/GBP pair initially shot much higher at the open on Thursday, but found enough resistance near the 0.88 level to turn around and roll over

The EUR/GBP pair initially shot much higher at the open on Thursday, but found enough resistance near the 0.88 level to turn around and roll over drastically. It looks as if the 0.8750 level is trying to offer support, so we continue to bang around in this area. I like this pair will be very noisy over the next several sessions, as we tried to decide which direction to go next. If we can clear the 0.8850 level, we are likely to go much higher, as it will have proven the 0.88 region to hold as support, which it is important on longer-term charts. Alternately, if we were to break down below the 0.8750 level, that would be a very negative turn of events and it should free this market to go down to the 0.86 level. Ultimately, I believe that this market continues to be a choppy market, and one that will make a decision soon.

Simply following the market

I believe that it’s probably best to simply follow the market, and not be bothered in the short term. If you do choose to trade the short-term charts, keep in mind that it is possible to do so, but you should be quick to take profits and of course set stop losses. I believe that the market will continue to be headline driven due to the divorce between the European Union and the United Kingdom, so of course we could get sudden moves in one direction or the other. However, once we break down of the range that we are in, I think we could get a nice move. Longer-term, we are still in an uptrend, but this is a notoriously choppy market, and of course this won’t be any different going into the future.

EUR/GBP Video 29.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement