Advertisement

Advertisement

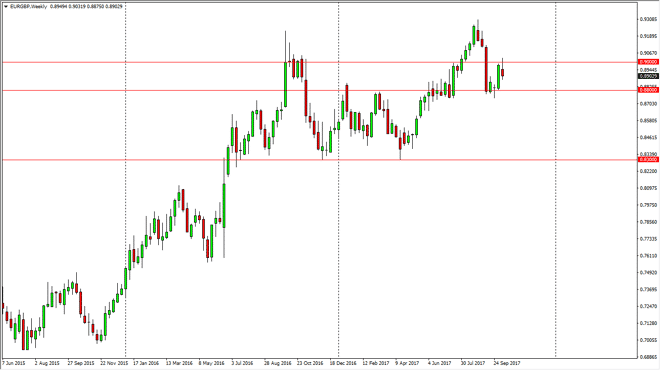

EUR/GBP forecast for the week of October 16, 2017, Technical Analysis

Updated: Oct 14, 2017, 05:31 GMT+00:00

The EUR/GBP pair initially rally during the week, breaking above the 0.90 level. However, we rolled over to form a bit of a shooting star, and that is a

The EUR/GBP pair initially rally during the week, breaking above the 0.90 level. However, we rolled over to form a bit of a shooting star, and that is a negative sign. Quite frankly though, I don’t think that the longer-term traders going to like this market for the short term, because I think we are bouncing around between the 0.88 level on the bottom, and the aforementioned 0.90 level. Once we break above the top of the weekly candle, then it would be a very bullish sign and I think we go looking towards the 0.93 level again. We are still very much in an uptrend, so I don’t have any interest in shorting this market, I am simply waiting to see a bullish sign to start buying again. While I recognize that the British pound is starting to show signs of strength again, the reality is that traders will continue to prefer the EUR over the Pound, mainly because of the certainty with trading in the European Union and the uncertainty when it comes to the United Kingdom.

Ultimately, this market will continue to be very noisy, it almost always is. However, when you look at the overall trend, it does start at the lower left and reaches to higher levels on the right. As long as that’s the case, I can’t fight what has been such a bullish move over the longer term, and I recognize that the consolidation just below the 0.88 level should continue to offer massive support, as there is so much in the way of noise and that range just underneath, and therefore I think it will continue to offer enough of a reason to look for supportive candles. So, while I believe that we could pull back a little bit now, it should only be a buying opportunity given enough time.

EUR/GBP Video 16.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement