Advertisement

Advertisement

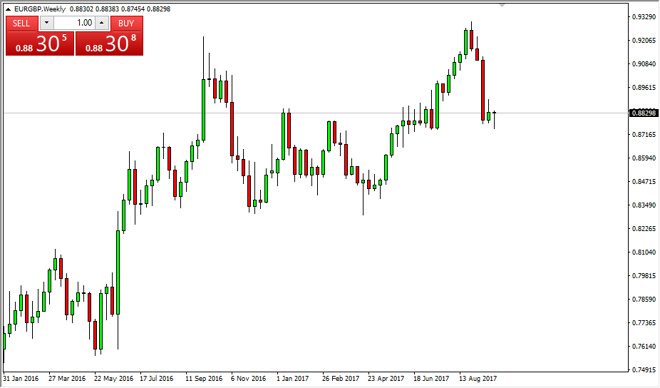

EUR/GBP forecast for the week of October 2, 2017, Technical Analysis

Updated: Sep 30, 2017, 05:18 GMT+00:00

The EUR/GBP pair initially fell during the week but found enough support below the 0.88 level to turn around and form a hammer. This is preceded by a

The EUR/GBP pair initially fell during the week but found enough support below the 0.88 level to turn around and form a hammer. This is preceded by a shooting star, but I find that we are in a very supportive level and an area that has caused a lot of noise on the charts over the longer-term. Because of this, I believe that we will eventually see this market go higher, and a break above the previous weeks candle would be reason enough to start putting money to work in aiming for the 0.93 level again. Remember, even though we’ve had a massive selloff as of late, we are still very much in an uptrend, and we’re just now testing the first true levels of support. Currently, it looks as if it is holding, and of course I believe that there a lot of concerns when it comes to the British economy. True, the Bank of England may raise interest rate relatively soon, but the European Central Bank is already starting to step away from quantitative easing, so this essentially could be a washout.

If that’s the case, then this market should continue to go much higher and I don’t see any reason why we won’t retest the previous highs. In fact, we could find ourselves going to the 0.95 level above, and then possibly parity. The market looks very likely to offer a nice longer-term buy-and-hold type of trade, but if we did breakdown below the 0.8650 level, at that point in time I would become much more concerned with the uptrend. However, at this point I don’t see anything that tells me anything different than this is a nice buying opportunity based upon value. With that, I remain bullish.

EUR/GBP Video 02.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement