Advertisement

Advertisement

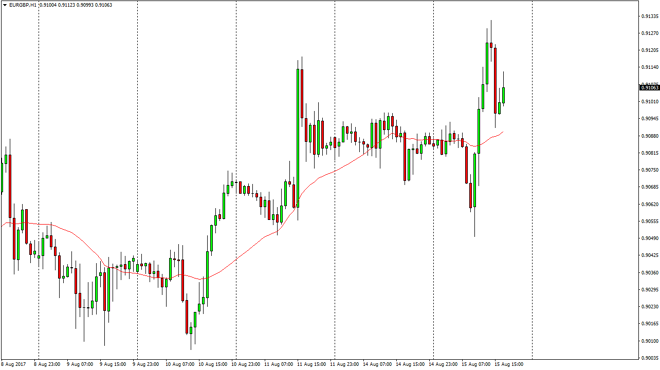

EUR/GBP Price Forecast August 16, 2017, Technical Analysis

Updated: Aug 16, 2017, 04:21 GMT+00:00

EUR/GBP rallied significantly after initially dipping on Tuesday. That being the case, the market looks likely to continue the uptrend overall, and I

EUR/GBP rallied significantly after initially dipping on Tuesday. That being the case, the market looks likely to continue the uptrend overall, and I believe that this recent pullback should be a buying opportunity given enough time. The British pound sold off rather drastically against the US dollar during the day, and that of course is the major benchmark as to how most currencies are measured. At the same time, while the EUR did fall, I wasn’t nearly as dramatic. Because of this, I believe that this pair continues to go to the upside as it is in the long-term uptrend anyway. Also, I believe the traders are more comfortable with the European Union than the uncertainty in the United Kingdom and the aftermath of leaving the EU.

I continue to buy dips

I look at dips as buying opportunities, and I also recognize that the 0.90 level underneath is the “floor” in the market. If we can break above the 0.92 handle, that frees the market to go to the 0.95 level, and then eventually parity over the longer term. Ultimately, I expect a lot of volatility, but every time it pulls back you should be thinking about the possibility of picking up a little bit of value. I don’t know that the longer-term move will hold more than a few months, but certainly right now it seems that this is more or less a “one-way bet.”

EUR/GBP Video 16.8.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement