Advertisement

Advertisement

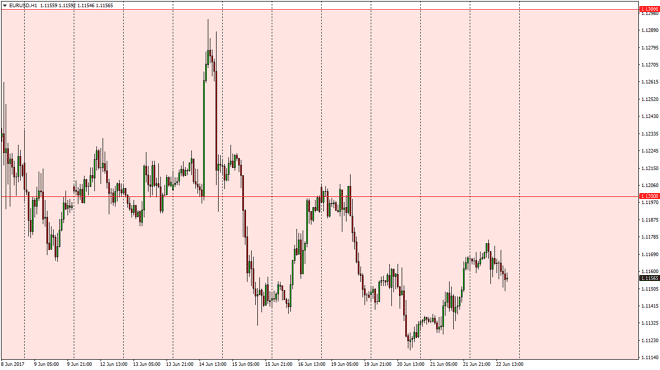

EUR/USD Forecast June 23, 2017, Technical Analysis

Updated: Jun 23, 2017, 03:43 GMT+00:00

The EUR/USD pair went sideways initially during the day on Thursday, as we hang around the 1.1150 level. The market started to roll over later in the day

The EUR/USD pair went sideways initially during the day on Thursday, as we hang around the 1.1150 level. The market started to roll over later in the day though, and it looks as if we are going to go back towards the 1.11 level, an area that should be supportive. Because of this, I think that we will find support underneath, and any sign of support is probably a nice buying opportunity. That should send this market looking for the 1.12 level, and perhaps even a break above there. A break above that level census market looking towards the 1.13 level, which is much more significant as far as resistance is concerned.

Longer-term consolidation

Ultimately, this is a market that has been consolidating between the 1.05 level on the bottom and the 1.15 level on the top. I think we will go fishing towards the 1.15 level above, as it is likely to be an area that is attractive to the market. I don’t think we are going to break above there, at least not anytime soon. However, it does look as if the market would probably be attracted to that level over the next several weeks, and that being the case it’s likely that the buyers will try to pick this market up from time to time. If we did breakdown below the 1.11 level, I think the market and goes down to the 1.10 level after that. Having said that, this is a market that will remain volatile, because of all the things going on with the British leaving the European Union, and of course the Federal Reserve raising interest rates soon of course will be a major influence on this market also. Things are starting look better in the European Union, so I think that’s part of what has been pushing this currency higher.

EURUSD analysis Video 23.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement