Advertisement

Advertisement

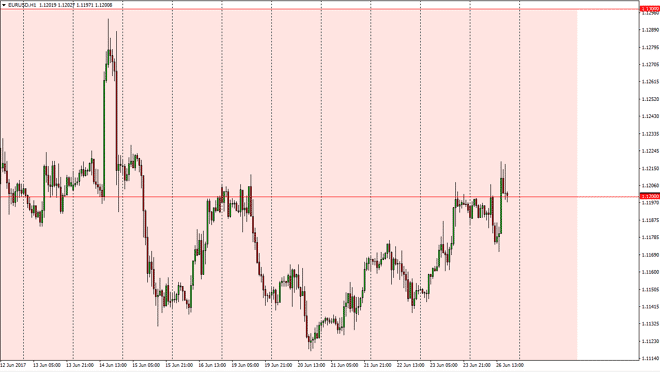

EUR/USD Forecast June 27, 2017, Technical Analysis

Updated: Jun 27, 2017, 06:54 GMT+00:00

The EUR/USD pair went sideways initially during the day on Monday, but found the 1.12 level above to be resistance. We broke down below there, and then

The EUR/USD pair went sideways initially during the day on Monday, but found the 1.12 level above to be resistance. We broke down below there, and then reached down to the 1.1175 level, where we found quite a bit of bullish pressure. We eventually broke above the 1.12 handle, and then pulled back there to find support yet again. Because of this, I believe that the pair is ready to continue going higher, perhaps trying to reach towards the 1.13 level over the longer term. I recognize that there is a lot of volatility in this market, and that being the case it’s likely that the EUR will continue to be a market that is difficult to deal with from time to time, and with this being the case, I think that we will into buying.

Support?

The 1.12 level has been “fair value”, and I think it should continue to be so. It looks as if the buyers are starting to take over, and if that’s the case I don’t see the reason we will reach towards the 1.13 level again. I think that the market will continue to offer plenty of buying opportunities on dips, but this is going to be short term in nature to say the least. The market is one that is going to be difficult to sell, least not until we break down below the 1.1170 level. Once we do that, the market should then go down to the 1.1125 handle.

If we could break above the 1.13 level, the market should then go to the 1.15 level above. That is a massive barrier on the longer-term charts, as we have been consolidating between the 1.05 level on the bottom and the 1.15 level on the top over the last 3 years.

EUR USD Forecast Video 27.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement