Advertisement

Advertisement

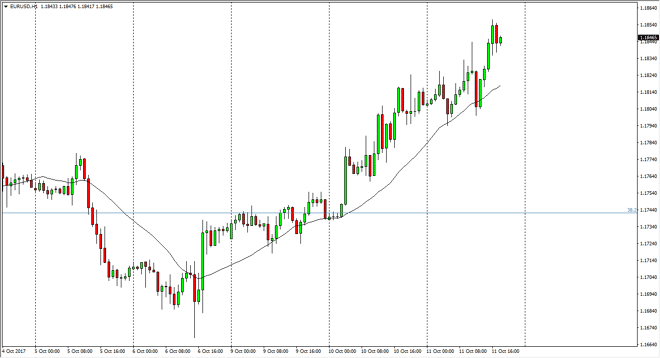

EUR/USD Forecast October 12, 2017, Technical Analysis

Updated: Oct 12, 2017, 04:59 GMT+00:00

The EUR/USD pair went sideways initially during the day on Tuesday, but then started to rally as we reached towards the 1.1850 level. That’s an area that

The EUR/USD pair went sideways initially during the day on Tuesday, but then started to rally as we reached towards the 1.1850 level. That’s an area that is minor at best, so I think that we pull back only to find buyers underneath. The 1.18 level should be massively supportive, so therefore a breakdown below there would be negative, but I believe that longer-term we are still going to go looking towards the 1.20 level above, which has a significant amount of resistance extending to the 1.21 handle. It’s not until we break above there that I think that we can continue the longer-term uptrend, but in the short term I think that buying on dips will probably continue to work out. The 24-hour exponential moving average on the chart has shown quite a bit of resiliency as support, so I think it’s a good way to measure the momentum of this market.

Ultimately, I think that we go to the 1.25 level, which is my longer-term target, but I also recognize that it’s going to take a long time to get there. We will probably try to reach that level after several attempts to breakout above the 1.20 level, which has significant longer-term ramifications. Ultimately though, we will have to pay attention to the Federal Reserve and their attitude when it comes to interest rate hikes, but right now most people believe that they are still getting ready to raise rates at the end of the year. The question now becomes how many times are they going to do it? Any signs of flinching or weakness out of the United States, and this pair will explode to the upside as the European Union continues the economic recovery that we have seen over the last several months.

Euro to Dollar Forecast Video 12.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement