Advertisement

Advertisement

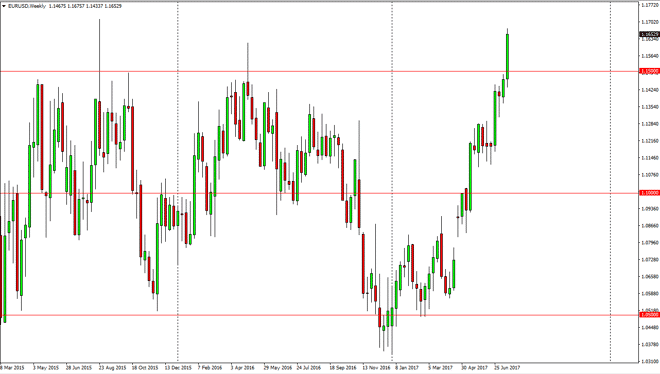

EUR/USD forecast for the week of July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:40 GMT+00:00

The EUR/USD pair initially fell during the week but sliced through the all-important 1.15 handle. This is a very bullish sign, and it suggests that we are

The EUR/USD pair initially fell during the week but sliced through the all-important 1.15 handle. This is a very bullish sign, and it suggests that we are getting ready to break out of a massive consolidation area. We have been stuck between the 1.15 level and the 1.05 level over the last almost 3 years, and now that we have gone through it I believe that a short-term pullback may happen because the market is overbought, but given enough time I believe the buyers will return. The 1.15 level should offer support as it was such resistance in the past. I think short-term pullbacks will offer buying opportunities, but longer-term it looks as if the market would be willing to go to the 1.1850 level over the next several months.

Choppiness

I think the one thing you can count on us choppiness because a lot of this is speculation on what the ECB will do, so between now and October it’s very likely that headlines will move this market back and forth. There is talk of quantitative easing coming to an end in the European Union, but this is also predicated upon the idea that the Federal Reserve won’t raise interest rates as quickly as once thought. It depends on what both those central banks do, so therefore headlines and comments will continue to drive this market back and forth and probably in a fairly erratic nature. In the meantime though, I believe that this market is biased to the upside, but given enough time I would expect that we may turn right back around if the Federal Reserve looks to be likely to continue its rate tightening cycle, which in my estimation they probably will. However, that remains to be seen.

EUR USD Forecast Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement