Advertisement

Advertisement

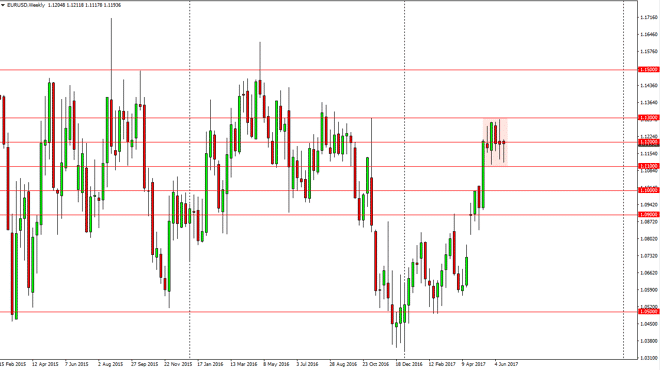

EUR/USD forecast for the week of June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:18 GMT+00:00

The EUR/USD pair initially fell during the week, but found enough support at the 1.11 level underneath to turn around and form a hammer. The hammer is

The EUR/USD pair initially fell during the week, but found enough support at the 1.11 level underneath to turn around and form a hammer. The hammer is preceded by shooting star, and a whole big mess of consolidation. Because of this, I think we are going to continue to bounce around in consolidation but I also believe there’s more of a proclivity to go to the upside as the 1.13 level has been targeted several times. A break above the 1.13 level should send this market to the 1.15 handle above which is a longer-term consolidation resistance barrier. The 1.05 level underneath has been support, and as we are getting closer to the top of this consolidation area, the market should be attracted to try to reach that area.

Choppiness

I think this market continues to chop around in this area, but like I said I believe in the upside more than the down. Because of this, it’s probably best to trade this market off short-term charts, but as long as we are above the 1.11 handle, I think that there is still plenty of buying pressure. Because of that, be aware the fact that dips could offer value. I believe that the market continues to be noisy, especially considering that the headlines coming out of the European Union can change at any moment due to the exit negotiations of the British. Because of this, the market should continue to be difficult to navigate, but long enough time frame would send this market higher, and I believe that the patient trader should be able to make money.

EUR USD Forecast Video 26.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement