Advertisement

Advertisement

EUR/USD Prediction for February 23, 2017

By:

The EUR/USD rebounded from its lows on Wednesday but continued its path lower, as yields in the U.S. rose at a quicker pace than European yields. The FOMC

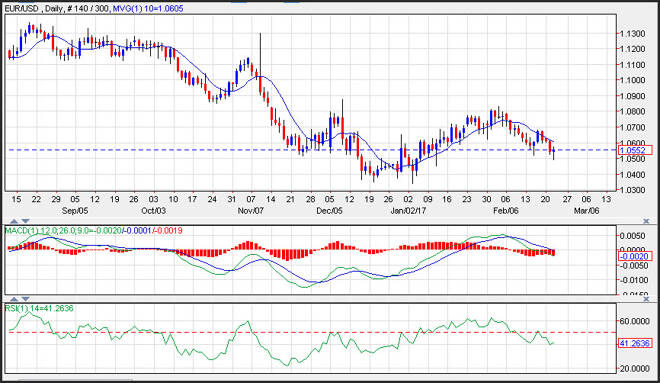

The EUR/USD rebounded from its lows on Wednesday but continued its path lower, as yields in the U.S. rose at a quicker pace than European yields. The FOMC said in its minutes that officials saw chance of a hike fairly soon if the economy remained on track. That’s not a new sentiment, however, and doesn’t hint strongly at March. German 2-year yield hit record low yield differential to U.S. as German bond markets continue to outperform as political risks and ECB tapering speculation keep the short end buoyed. Support is seen near Wednesday’s lows at 1.0493, and then the January lows at 1.0340.

Futures Point to a 18% change of a Rate Hike

Momentum remains negative as the MACD (moving average convergence divergence) index prints in the red with a downward sloping trajectory which points to a lower exchange rate. The RSI is printing a reading of 43, which is on the lower end of the neutral range. Fed fund futures suggests about an 18% chance for a tightening in March.

About the Author

David Beckerauthor

David Becker focuses his attention on various consulting and portfolio management activities at Fortuity LLC, where he currently provides oversight for a multimillion-dollar portfolio consisting of commodities, debt, equities, real estate, and more.

Advertisement