Advertisement

Advertisement

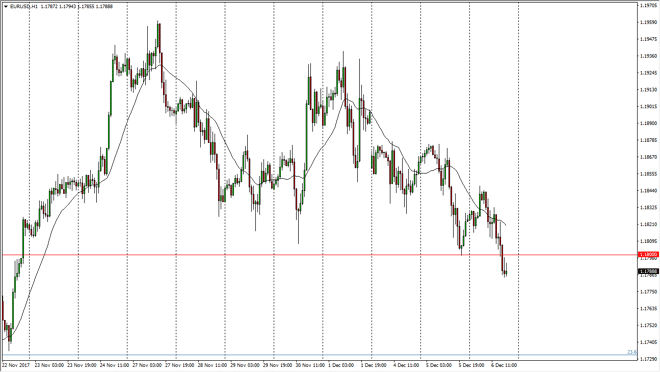

EUR/USD Price Forecast December 7, 2017, Technical Analysis

Updated: Dec 7, 2017, 06:01 GMT+00:00

The EUR/USD pair initially tried to rally during the trading session on Wednesday, but then rolled over to break below the 1.18 level. At this point, if we rally back above the 1.18 level, that would be a bullish sign, otherwise we could go lower.

The EUR/USD pair bounced significantly during the trading session initially on Wednesday, but then rolled over to break down below the 1.18 level underneath. By breaking down below there, I think that the market probably goes down to the 1.17 level. Ultimately, this is a market that should continue to be volatile, but I think that the buyers will be coming back relatively soon. We have the tax legislation in the United States that of course can cause quite a bit of volatility with the US dollar, so pay attention to that as well. Ultimately, if we do break down below the 1.1775 level, the market probably looks at the 1.17 level which is much more important. However, I still am longer-term bullish of this pair, recognizing that the breakout lately was very bullish.

This is a very noisy market, as we have headlines that can move the marketplace coming out of politicians Maus. We also have the situation where the United Kingdom is discussing the break away from the European Union, so there are a lot of moving pieces. There has been a bit of a pullback in the stock markets recently, as we have seen a lot of volatility, and that of course influences this pair as well. The 1.21 level above is the ultimate target, and if we can break above there becomes more of a complete trend change. Until then, expected this choppiness, but I do believe that the buyers will return eventually.

Euro to Dollar Forecast Video 07.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement