Advertisement

Advertisement

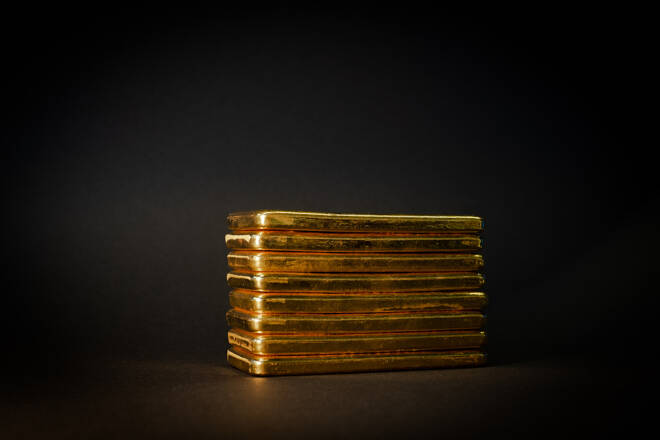

Events Over the Next Two Days Will Dramatically Impact Gold Prices

By:

Data from Tuesday’s inflation report will be a key element in shaping the decisions made by the Federal Reserve which will be announced on Wednesday.

US CPI and Central Bank Meetings On Tap

Globally central banks are set to announce interest rate revisions this week including the European Central Bank, Bank of England, and the Swiss National Bank. In the United States, market participants are bracing for two key events to occur on Tuesday and Wednesday of this week.

On Tuesday the government will release the CPI index report for November, the last report for this year. On Wednesday the Federal Reserve will conclude its last FOMC meeting this year which will be followed by the release of a Fed statement and a press conference by Chairman Jerome Powell.

Data from Tuesday’s inflation report will be a key element in shaping the decisions made by the Federal Reserve which will be announced on Wednesday. Currently, the Fed is expected to implement a 50-bps rate hike. According to the CME’s FedWatch tool, there is a 74.7% probability that the Fed will raise rates by 50 bps and a 25.3% probability of a 75 bps rate hike.

Inflation Expectations

It is widely expected to show that inflation for November moderated slightly although it is still running almost 3 times the pace that occurred before the pandemic.

According to FactSet, the consensus estimates are:

- CPI to rise 0.35% for the month versus 0.4% in October.

- Core CPI to rise 0.3% for the month versus 0.3% in October.

- CPI, year over year, to rise 7.3% versus 7.7% in October.

- Core CPI, year over year, to rise 6.1% versus 6.3% in October.

If these forecasts prove to be correct it would reinforce the Federal Reserve’s decision to raise rates by 50 bps rather than 75 bps as it has done over the last four consecutive FOMC meetings. However, it is important to note that recent statements by Federal Reserve members including the chairman stated that it will take longer to align inflation to their target level of 2%.

Above is a graph created by Bloomberg News which contains the survey of economists as it pertains to levels of lower inflation next year and the first and second quarters of 2024. The graph demonstrates a strong decline in inflation by Q2 2023 from its current average of 7.4% to 4.3%. It also illustrates that the timeline to bring inflation to the Federal Reserve’s target level of 2% will not occur until after the second quarter of 2024.

Gold Today

Today gold sold off sharply breaking below $1800 and its 200-day moving average which is currently fixed at $1799.10. As of 5:01 PM EST gold futures basis the most active February 2023 Comex contract is fixed at $1792.9, after factoring in today’s strong decline of $17.60 or 0.97%. Today’s decline was slightly aided by dollar strength. The dollar gained 0.20% with the dollar index currently fixed at 105.005. This means that the vast majority or 4/5 of today’s decline can be directly attributed to market participants actively selling the precious yellow metal.

The real question becomes what costs will there be in terms of recessionary pressures from the restrictive and tight monetary policy which has raised interest rates at every FOMC meeting since March of this year. It is clear to many analysts including myself that it is not if a recession will occur as a direct result of the rate hikes enacted by the Federal Reserve, but rather how deep of a recession will result from their actions.

For those who would like more information simply use this link.

Wishing you as always good trading,

Gary S. Wagner

About the Author

Gary S.Wagnercontributor

Gary S. Wagner has been a technical market analyst for 35 years. A frequent contributor to STOCKS & COMMODITIES Magazine, he has also written for Futures Magazine as well as Barron’s. He is the executive producer of "The Gold Forecast," a daily video newsletter. He writes a daily column “Hawaii 6.0” for Kitco News

Advertisement