Advertisement

Advertisement

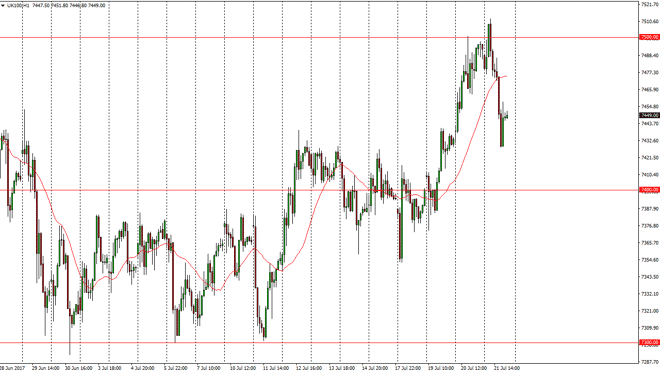

FTSE 100 Index Forecast July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:04 GMT+00:00

The FTSE 100 fell during the day after initially trying to break above the 7500 level on Friday. Because of this, looks like we are not quite ready to

The FTSE 100 fell during the day after initially trying to break above the 7500 level on Friday. Because of this, looks like we are not quite ready to take off to the upside, and it looks likely that the 7400-level underneath should continue to be supportive. I think we are looking to find buyers in that general area, and once we do get some type of bounce, I’d be willing to buy this market. If we can break out to a fresh, new high, the market should continue to go towards the 7600 level above. Longer-term, we are in an uptrend but I also recognize that there will be a lot of volatility when it comes anything involving the United Kingdom due to the divorce proceedings from the European Union.

Buying dips

I continue to think that this is a market that you can buy dips in. There should be plenty of support underneath, especially near the 7400 level, so I think that it’s only a matter of time before the market find some type of reason to go long. I believe that support extends down to the 7350 handle, and therefore is going to take a significant amount of work to break down below there. If we did, then the most obvious place would be the 7300 level. I still believe in buying dips, and therefore that’s exactly how I’m going to approach this market longer term, and believe that most traders around the world look at the FTSE 100 as value waiting to happen, especially considering how many people were against the idea of the United Kingdom overall. Personally, I believe that the market will continue to grind higher, and the pullbacks continue to be areas where you can add to a longer-term core position.

FTSE 100 Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement