Advertisement

Advertisement

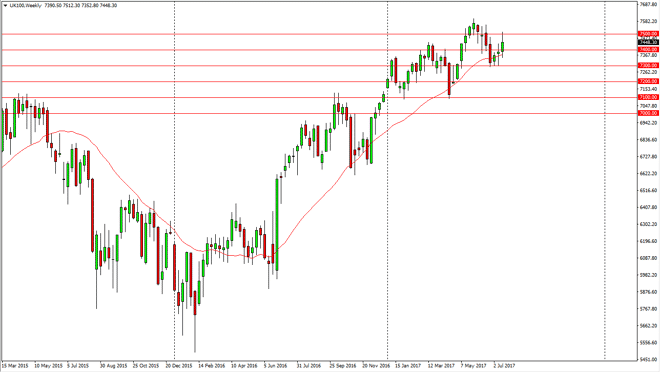

FTSE 100 Index forecast for the week of July 24, 2017, Technical Analysis

Updated: Jul 22, 2017, 06:43 GMT+00:00

The FTSE 100 had a slightly positive week as we initially tried to reach above the 7500 level, but found too much in the way of resistance above there.

The FTSE 100 had a slightly positive week as we initially tried to reach above the 7500 level, but found too much in the way of resistance above there. However, as the week wore on the British pound lost some strength and that of course is good for exports when it comes out of the United Kingdom. I believe that if we can break above the top of the shooting star on the week, we should continue to go much higher, perhaps reaching towards the 7600 level. I think that pullbacks will continue to be supported, especially near the 7300 level. This is a market that should continue to find plenty of upward pressure longer-term due to the overall uptrend. I think that the market may continue to be choppy, but it should have overall bullish pressure.

Buying dips

I continue to look at dips as value in this market, and I believe that eventually we could break out to a fresh, new high. A breakdown below the 7300 level could be negative, sending this market down to the 7200 level next, and then even the 7100 level. I believe that there is a massive amount of support between the 7000 handle on the bottom and the 7100 level above that. Because of this, I am waiting to see the market breakdown below the 7000 handle before I would consider selling. At that point, I would anticipate that the market would go to the 6650 handle. Until all of that happens, the only thing I can do is by this market as it is so strong in general. Longer-term, I anticipate that the market will probably go looking for the 8000 handle above, which is a large, round, psychologically significant target.

FTSE 100 Video 24.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement