Advertisement

Advertisement

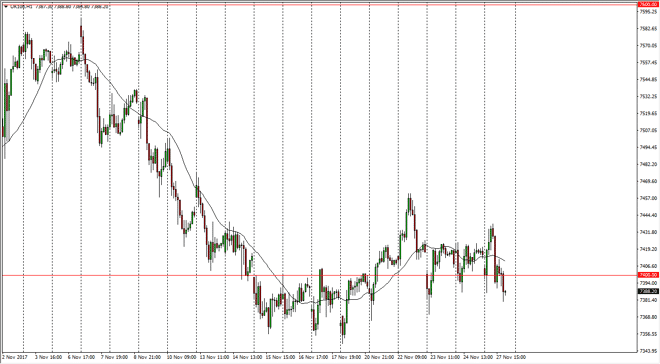

FTSE 100 Index Price Forecast November 28, 2017, Technical Analysis

Updated: Nov 28, 2017, 05:27 GMT+00:00

The FTSE 100 initially gapped lower at the open on Monday, but then found enough support at 7400 a bounce rather significantly. We gained about 40 points

The FTSE 100 initially gapped lower at the open on Monday, but then found enough support at 7400 a bounce rather significantly. We gained about 40 points as that happened, but ended up giving those back, and breaking below the 7400 level again. However, I see a significant amount of order flow just below, and that we should rally from here longer term. I think if we can break above the 7450 handle again, that should signify that the buyers are ready to go much higher, perhaps aiming for the 7600 level after that. I believe that the market has a lot to chew through in that general vicinity, so it’s not necessarily going to be an easy move. In general, the 7400 level is an area I am looking at as “fair value” in a market that has been chopping around between the 7200 level on the bottom, and the 7600 level on the top over the last several months. I think that the market will eventually break out, but it may take some building to do so.

If we were to break down below the 7200 level, that would be very negative, and should send the market down to the 6600-level based upon the measured move. Alternately, a breakout above the 7600 level should send the market to the 8000-level based upon those same measurements. I do prefer the upside, because quite frankly equities continue to have money flow into them regardless what happens. I believe that most indices are approaching an extreme overbought condition, but I certainly don’t want to step in front of this type of massive move, and I think that most traders feel the same way. Because of this, I am simply waiting for a breakout above the 7450 level to put money to work.

FTSE 100 Video 28.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement