Advertisement

Advertisement

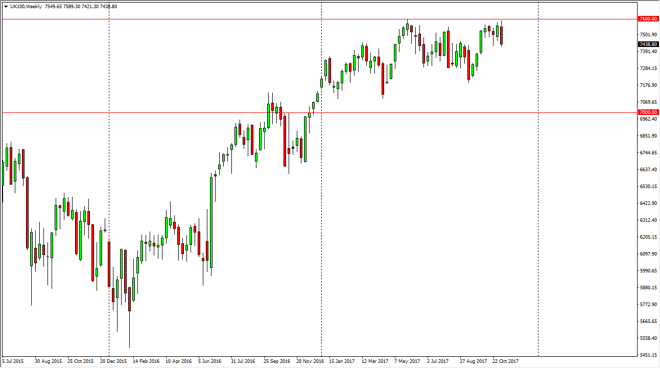

FTSE 100 Index Price forecast for the week of November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:11 GMT+00:00

The FTSE 100 rallied initially during the week, but found enough resistance at the 7600 level to turn around and rollover significantly. The negative

The FTSE 100 rallied initially during the week, but found enough resistance at the 7600 level to turn around and rollover significantly. The negative weekly candle of course suggests that we are going to fall from here, but I also recognize that there’s a lot of support underneath, especially near the 7200 level. I believe that a pullback should offer plenty of support in a market that is obviously in an uptrend. It makes sense that the market should go sideways in general though, as we had been so bullish in the past. Ultimately, I think that this is simply the market trying to build up enough momentum to go higher, breaking above the 7600 level, and extending to the 8000 handle.

In the meantime, I think it’s probably best to stand on the sidelines, I would not want to short this market, because there is so much in the way of extended bullish pressure. I think that eventually the buyers will get what they need, and we will go higher. The 8000-level course is the next large, round, psychologically significant number, so it makes a perfect target. It also makes a lot of sense considering that we are presently consolidating in a 400-point range, so by adding the 400 points to the breakout at 7600, you get the measured move to the 8000 handle. Overall, the market looks likely to fulfill that move, so I like the idea of buying the dips, not trying to short it. I’m waiting a couple of weeks, you should get the opportunity to do just that, pick up value in an overall uptrend, that should continue to drive this market towards our goal. It is not until we break down below the 7000 level that I would be a seller.

FTSE 100 Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement