Advertisement

Advertisement

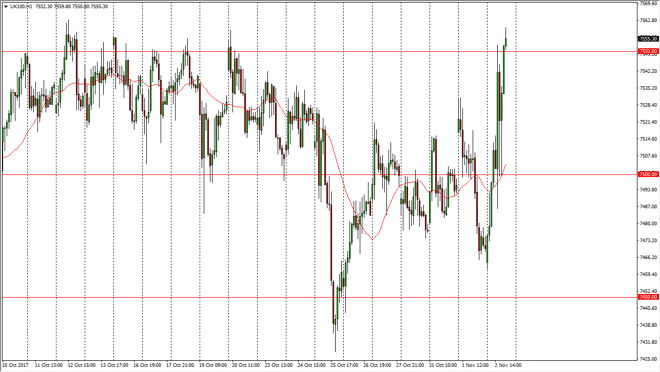

FTSE 100 Price Forecast November 3, 2017, Technical Analysis

Updated: Nov 3, 2017, 05:19 GMT+00:00

The FTSE 100 rallied rather significantly during the day on Thursday, as although the Bank of England raised interest rates during the day, it’s likely

The FTSE 100 rallied rather significantly during the day on Thursday, as although the Bank of England raised interest rates during the day, it’s likely that the market was reacting to Mark Carney suggesting that interest rate hikes are going to be very slow, and that brought down the value of the British pound. By extension, this brought a lot of buying pressure into the FTSE 100, as the exports coming out of the United Kingdom should continue to be cheap historically speaking, giving more profits to those companies. Now that we have broken above the 7550 handle, we are starting to show signs of exhaustion, and quite frankly that makes a lot of sense considering that we had formed such an impulsive move. If we drop below the 7550 handle, I’m not interested in selling, what I’m waiting to do is see some type of support underneath to start buying. I think the 7500 level should be supportive, but I also recognize that a move above the highs for the day could send this market towards the 7600 level, which has been my target for some time.

I believe that the market will eventually find of buying pressure underneath to continue moving to the upside, and although it is going to be very choppy and difficult to deal with, I think that those who are more long-term minded will be rewarded by going to the upside and perhaps adding on a fresh, new high. In general, this is a market that seems to be rather strong overall, and we should see the attitude of participants remain bullish, especially if the British pound struggles for any significant length of time. I have no interest in selling the FTSE 100, we have seen so much in the way of buying pressure.

FTSE 100 Video 03.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement