Advertisement

Advertisement

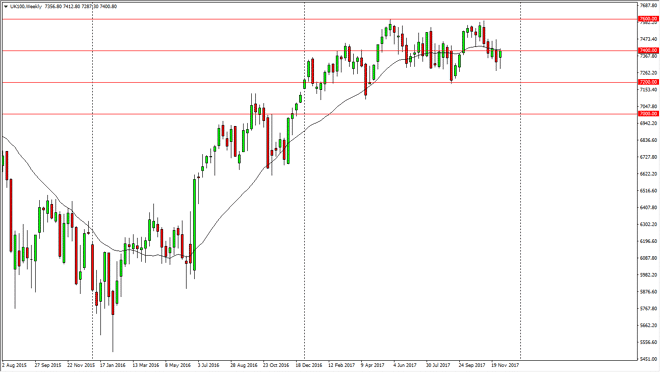

FTSE 100 Price forecast for the week of December 11, 2017, Technical Analysis

Updated: Dec 9, 2017, 08:14 GMT+00:00

The FTSE 100 has been volatile during the week, initially dropping but has found enough buying opportunities and pressure to rally and form a nice-looking hammer. The hammer sits just below the 7400 level.

The FTSE 100 has pulled back during the week, but found enough bullish pressure to turn around and form a hammer. A break above the top of the hammer should be a bullish sign, perhaps send in the market towards the 7600 level. Because of this, I think that the market should continue to be volatile, but it seems likely that we will struggle between here and there. Given enough time, I anticipate that the FTSE 100 will break above the 7600 level, as the negotiations between London and Brussels seem to be going better than originally thought. At this point, I suspect that the United Kingdom will start to look relatively cheap, and therefore I think that we will see the FTSE 100 extend the gains.

Currently, I see the 7200 level as a significant support level, so it’s not until we break down below there that I would be concerned. I think we are simply going sideways in general as we have all year, building up enough momentum to finally break out to the upside as fears of the UK leaving the EU are starting to subside. As it appears that there is no longer an issue of Armageddon, United Kingdom will start to pick up value. If we did breakdown below the 7200 level, I think that there is also support at the 7000 handle. Because of this, I still believe in buying the dips, buying a breakout above the top of the candle, and most certainly buying a break above the 7600 level are all excellent opportunities for buyers.

FTSE 100 Video 11.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement