Advertisement

Advertisement

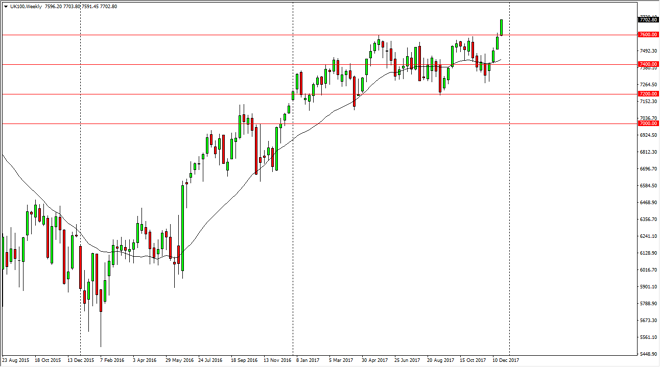

FTSE 100 Price forecast for the week of January 2, 2018, Technical Analysis

Updated: Dec 30, 2017, 07:08 GMT+00:00

The FTSE 100 has exploded to the upside during trading this past week, reaching above the 7700 level during the last hour of Friday trading. This is a very bullish sign as we finish the year on the highs, and it looks bright for the FTSE 100.

FTSE 100 traders broke above the 7600 level, reaching towards the 7700 level above. This happened on Friday and thin volume, but this has been a bullish market of the last several weeks anyway, so it makes sense that we would eventually break out. I believe that pulling back at this point should be thought of as a buying opportunity and the 7600 level should be the “floor.” When I look at this chart, we have been steadily climbing 200 points with each move, so I anticipate that we are going to go to the 7800 level above. The overall consolidation for the year has been between 7200 on the bottom, and 7600 on the top. Because of this, the move measures to reach the 8000-level given enough time.

Looking at the moving averages, we are starting to turn higher, and therefore I think it makes sense that longer-term traders are willing to get involved, and do the “buy-and-hold” trade necessary to keep money flowing in. When you look at the overall attitude of the market for the last 18 months, we have been in somewhat of an up-trending channel, so I see nothing on this chart that suggests we should be looking at a negative position. Not only do I think we reach the 8000 handle, I believe we go much higher than that as the market continues to be thought of as positive in stock markets around the world continue to be bullish.

FTSE 100 Video 02.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement