Advertisement

Advertisement

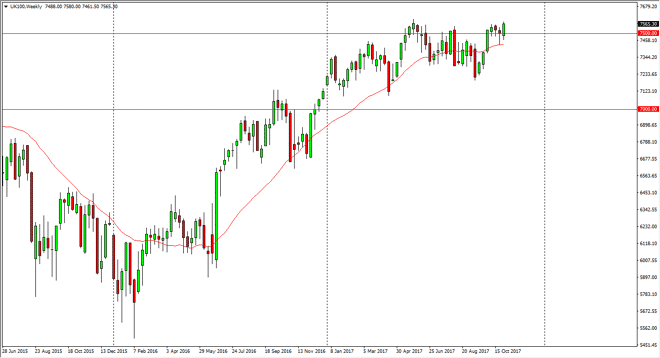

FTSE 100 Price forecast for the week of November 6, 2017, Technical Analysis

Updated: Nov 4, 2017, 06:15 GMT+00:00

The FTSE 100 initially fell during the week but then shot through the 7500 level. Break above that level is a good sign, and when I look at the last 6

The FTSE 100 initially fell during the week but then shot through the 7500 level. Break above that level is a good sign, and when I look at the last 6 months, it looks like we are forming some type of basing pattern, and I think that we will eventually go much higher. Paying attention to the British pound is exactly what you should be doing right now, which it looks very likely to roll over. Because of this, the market may reward the FTSE 100 with the thought of cheaper British exports. If that’s the case, the market then goes looking towards the 7600 level, and eventually my longer-term target, the 8000 handle. In the meantime, I think that pullbacks offer value, and the hammer that had formed from the previous week looks likely to be massively supportive.

I think that we will get volatility from time to time, but overall the moving averages are starting to turn up words, and that always is a good sign. In fact, it’s not until we break down below the 7300 level that I begin to worry about the uptrend. We may bounce around in the short term, but overall, we are in an uptrend and there is nothing on this chart that tells me things are about to change anytime soon. As a side note, if the GBP/USD pair breaks down below the 1.30 level, that could be very negative for the currency, and by extension be a bit of a massive boost for this market. I like the FTSE 100, because with the pessimism that we continue to see around the United Kingdom, it’s likely that the market will continue to rally as currency traders punish the UK. Beyond that, interest rate hikes seem to be coming much slower than originally thought.

FTSE 100 Video 06.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement