Advertisement

Advertisement

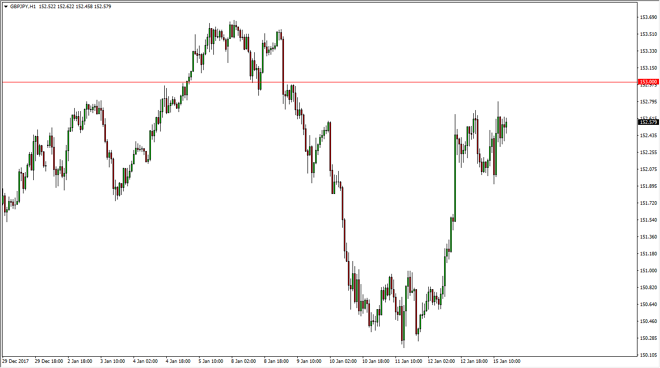

GBP/JPY Price Forecast January 16, 2018, Technical Analysis

Updated: Jan 16, 2018, 05:37 GMT+00:00

The British pound has rally during the trading session on Monday, as we approach the significant 153 handle. If we can break above there, that’s a big deal, and with the massive amount of bullish pressure that we had seen underneath, it’s likely that we will continue to find noisy upward pressure.

The British pound has significantly rally during the day overall, and the market has been very bullish on Friday as well. Because of this, I think it’s likely that we continue to see momentum building exercises present themselves, and I think that short-term pullbacks are buying opportunities as we should then try to break above the 153 handle. Once we do, that is a major barrier that the market had recently cleared for the short term. If we can finally make a fresh, new high, that signifies that this pair probably goes to the 163 handle later.

In the meantime, I think that pullbacks are buying opportunities, as the 150 level has offered a major support barrier. That is the area that of course was always going to offer a significant amount of support based upon the large, round, psychologically significant number. In fact, it’s not until we break down below the 150 level that I would consider selling. I think that pullbacks offer value, as the British pound has been showing significant strength over the last year, especially as the US dollar. This market breaking above to a fresh, new high signifies that there would be more of a “risk on” attitude in the markets in general, and that’s almost always good for this pair. The 153 level will probably offer a bit of noise, so if you do go long between now and a breakout of that level, I would add slowly, and then become more aggressive once we reach the fresh, new high.

GBP/JPY Video 16.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement