Advertisement

Advertisement

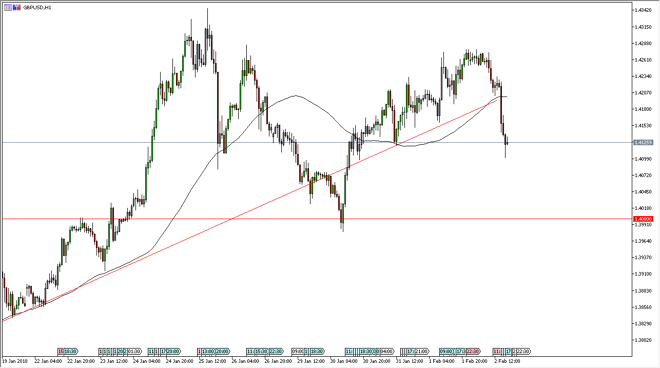

GBP/USD Price Forecast February 5, 2018, Technical Analysis

Updated: Feb 3, 2018, 05:43 GMT+00:00

The British pound has fallen significantly during the trading session on Friday, showing signs of negativity yet again. However, the jobs number had a lot to do with what happened, and this is typically a short-term effect as the fundamentals don’t change.

The British pound has broken down during the Friday session, slicing through the 72-hour exponential moving average. By doing so, it became very short-term, but we are starting to see the 1.41 level offer a bit of support. I think if we can break out above the 1.4150 level, the market probably goes much higher, reaching towards the 1.43 level again. The market continues to look healthy, and I think that even with a significant pullback, we should see buyers looking for the British pound “on the cheap.”

A lot of weak hands would have gotten pummeled on Friday, but longer-term and larger traders will be looking at this as an opportunity to pick up even more British pounds at a lower level. The 1.40 level underneath should be thought of as the “floor” in the market, and I believe that we are going to continue to see the overall uptrend continue. The US dollar has sold off for a reason and should continue to as it looks likely that the Forex markets have made up their minds for the 2018 handle. The British pound should be one of the beneficiaries, as it has been so cheap for so long, and of course the market has overreacted to the vote to leave the European Union. The reported death of the UK was overdone, and most certainly premature. I believe that the market will continue to find reasons to go long, and longer-term traders are looking to add on these dips. Friday should have been yet another opportunity.

GBP/USD Video 05.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement