Advertisement

Advertisement

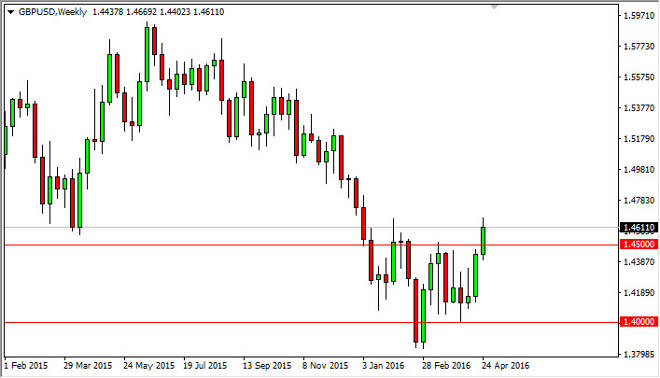

GBP/USD forecast for the week of May 2, 2016, Technical Analysis

Published: Apr 30, 2016, 04:23 GMT+00:00

The GBP/USD pair broke higher during the course of the session on Friday, as we continued the move from the momentum from the previous part of the week,

The GBP/USD pair broke higher during the course of the session on Friday, as we continued the move from the momentum from the previous part of the week, and it looks as if the British pound is trying to break out to the upside for the longer-term move. If we break above the top of the range for the week, it’s very likely that we are going to reach towards the 1.5 handle given enough time. It’s a large, round, psychologically significant number obviously, so there will be sellers in that area to keep the market somewhat down. However, there is quite a bit of bullish momentum underneath if we do pullback, so with that being the case we feel that buyers will return to this market every time there’s a hint of support and of course value in a market that certainly looks like it’s trying to turn the longer-term trend around, and that could be a long-term trade just waiting to happen.

We do have the British voting in June on whether or not to stay in the European Union, so that of course will continue to be a little bit of a weight upon the British pound in general. Ultimately, this is a market that will also have to deal with the Federal Reserve and its lack of clarity on interest-rate hikes as well. It still appears that the Americans will raise interest rates later this year, but having said that it looks as if there will be interest rate hikes, so with this being the case at this point in time we will have to look to what both central banks will have to do. The British public will decide the fate of the British pound later this summer, but the Federal Reserve will certainly decide the fate of the dollar. It appears that traders are starting to look at the US dollar as a little less certain that once was as seen in other markets such as the gold markets rising. With this, we suspect that this pair will break out.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement