Advertisement

Advertisement

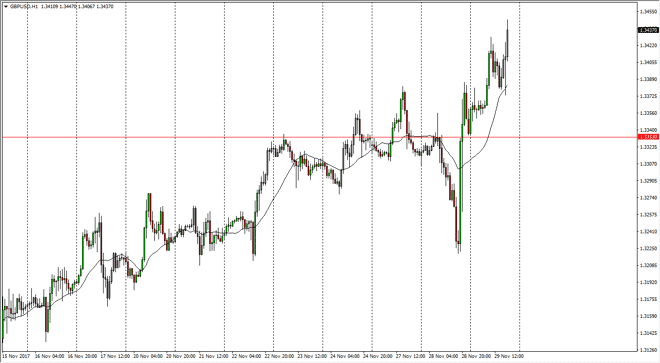

GBP/USD Price Forecast November 30, 2017, Technical Analysis

Updated: Nov 30, 2017, 05:04 GMT+00:00

The British pound initially rally during the day on Wednesday, but then pulled back after reaching the 1.34 handle. By doing so, it looks as if we found

The British pound initially rally during the day on Wednesday, but then pulled back after reaching the 1.34 handle. By doing so, it looks as if we found more buyers just below, and the market continue to reach towards the 1.3450 level. I believe that the market will continue to be a “buy on the dips” scenario, as the British pound is getting a bit of reprieve after it was announced that the United Kingdom and the European Union are green to terms of a fee to pay for exiting the European Union. The 1.3333 level looks to be support going forward, and a bit of a floor. Because of this, if we can stay above there I think that buying is the only thing you can do and it is only a matter of time before we reach towards the important 1.35 level above. Above there, the next target will be the 1.3650 level which is a scene of a massive gap lower.

If we can break above that level, the market is more than likely going to continue to go much higher, perhaps reaching towards the 1.40 level after that. That level will course be important because it is a psychologically important level, but in the big scheme of things I don’t think it’s particularly important. In other words, once we break above the 1.3650 level, the market is likely to continue going much higher, perhaps for the long term.

I believe that the alternate scenario would be a breakdown below the 1.3333 level, which would send this market looking for the 1.3250 level after that. A breakdown below there would probably have the market looking for the 1.30 level, although I think that is the least likely of all of the scenarios that I see.

GBP/USD Video 30.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement