Advertisement

Advertisement

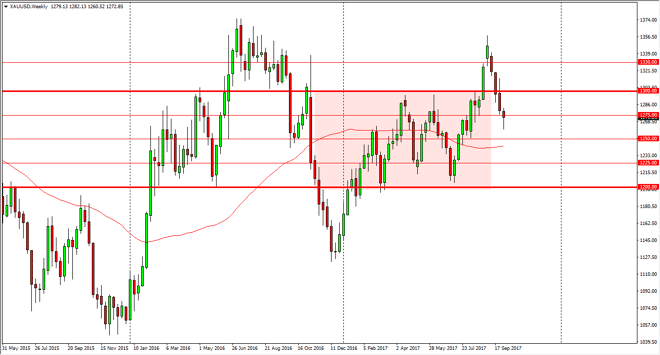

Gold forecast for the week of October 9, 2017, Technical Analysis

Updated: Oct 7, 2017, 06:30 GMT+00:00

Gold markets fell significantly during the week, but found a bit of support on Friday as it was revealed that North Korea would be testing a rocket that

Gold markets fell significantly during the week, but found a bit of support on Friday as it was revealed that North Korea would be testing a rocket that could reach the western part of the United States over the weekend. However, I think that most of this is being used as an excuse to take advantage of what has been an impulsive move higher. I was a bit surprised that we broke down below the $1300 level, as it was significant resistance in the past. That normally means that we should see a significant amount of support, so having said that I think that the market forming this hammer suggests that we are going to reach towards the $1300 level above. If we can break above that, the market should continue to go much higher, perhaps reaching towards the $1350 level next.

If we break down below the bottom of the hammer, the market should then go down to the $1250 level underneath. This is a market that continues to see a lot of noise in this area, and thereby should see a lot of order flow. I suspect that you should pay attention to the US dollar in general, and see how it does. If it continues to follow the downward trajectory that it has been over the last couple of sessions, we could see a bit of bullishness in gold as well. A breakout above the $1300 level is very bullish, but I don’t think it’s going to be easy to get there. I also recognize that the volatility is going to continue, so therefore low leverage is probably the best way to trade this market as you will continue to see a lot of noise in the gold pets.

Gold Price Video 09.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement