Advertisement

Advertisement

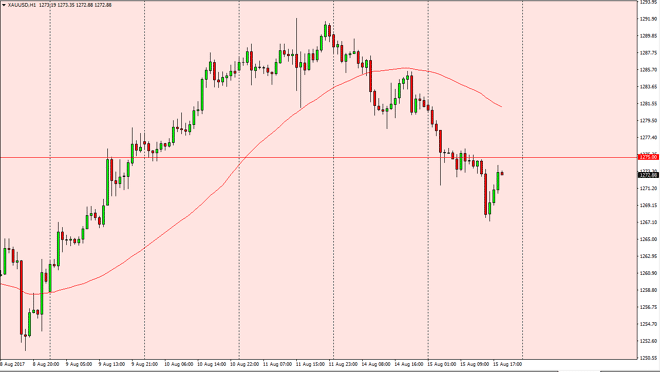

Gold Price Forecast August 16, 2017, Technical Analysis

Updated: Aug 16, 2017, 08:37 GMT+00:00

The gold markets broke down during the session on Tuesday, slicing through the $1275 level. However, later in the day we started to bounce back towards

The gold markets broke down during the session on Tuesday, slicing through the $1275 level. However, later in the day we started to bounce back towards that reason, and I think that the sellers may be looking to get involved in the market near there. On signs of exhaustion, I’m willing to sell this market as I think we are going to go looking for the $1250 level underneath. That’s an area that has been important in the past, as it is essentially the middle point of the overall consolidation area. Because of this, it makes sense that the market will try to go back down to that area. This market has been bouncing between the $1200 level on the bottom and the $1300 level for some time, and the recent bullish pressure has been all about North Korea. As that situation calms down, it makes sense that the market should drop.

The US dollar

The US dollar has rallied as well, as the retail sales number came out much stronger than anticipated. That of course makes quite a bit of sense as it makes a rate hike from the Federal Reserve much more possible. I believe that the gold markets are going to eventually selloff given enough time, and therefore I look at these rallies as nice opportunities to short a market that certainly has been overextended recently. I think that the market will more than likely find quite a bit of volatility near the $1250 level, as longer-term traders will come into play. Most of the so-called “hot money” is simply fear trading more than anything else, and that of course very rarely makes for much in the way of a longer-term trend. Ultimately, the volatility should continue, but I preferred the downside.

Gold Outlook Video 16.8.17

Click here is you wish to join the prestigious club of Forex traders

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement