Advertisement

Advertisement

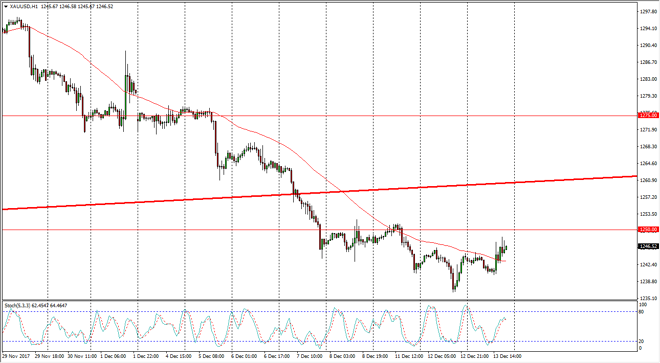

Gold Price Forecast December 14, 2017, Technical Analysis

Updated: Dec 14, 2017, 05:59 GMT+00:00

Gold markets will certainly be an interesting place to be over the next 48 hours, as the Federal Reserve will release a statement during the late part of the Wednesday session that could have a massive effect on the US dollar.

Gold markets continue to dance around the $1250 level, an area that has been “fair value” over the longer-term charts. Because of this, I think that once we get the statement and more importantly, the aftereffect, of the Federal Reserve announcement during the Wednesday session, we should have more clarity in this market. If we can break above the $1265 level, I think that gold will go looking towards the $1275 level, and then eventually the $1300 level after that. Alternately, if we break down below the $1225 level, we probably go fishing towards the $1200 level underneath, which is the bottom of the overall consolidation.

Gold is essentially a “anti-dollar” play in times like this, and I think that will continue. If the US dollar rolls over, perhaps with the Federal Reserve being a bit more dovish than expected, gold should rally rather significantly. On the other hand, if the US dollar skyrockets because of a hawkish Federal Reserve, gold will fall apart. I think there is a lot riding on this announcement, and it could give us directionality for 2018. That being said, be very cautious and take your time getting involved in this market, perhaps waiting for some type of daily candle that is impulsive, telling us which direction the market may move over the next several months. We live in very interesting times, and I think that will continue to be reflected in the gold markets in general. Volatility should continue, so what you do get involved, build your position slowly.

Gold Price Forecast Video 14.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement