Advertisement

Advertisement

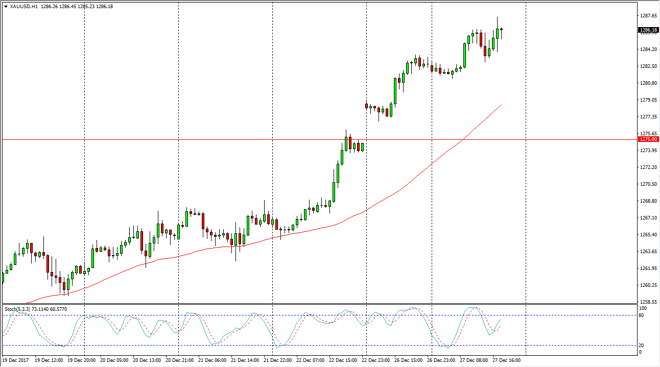

Gold Price Forecast December 28, 2017, Technical Analysis

Updated: Dec 28, 2017, 05:03 GMT+00:00

Gold markets of course were volatile during the thin trading session on Wednesday, with an upward slant. Because of this, looks as if we are going to continue to see buyers jumping into the marketplace.

Gold markets of course rally during the day, as we have seen more of a “risk on” move, as the US dollar has been falling. This is naturally good for gold, and it looks as if we are ready to go looking towards the $1300 level given enough time. If we pull back from here, I think there is a massive gap at the $1275 level underneath, and of course the fact that the market has been active in this general vicinity.

The gap of course is a very supportive area in and of itself, but we also have several moving averages rallying, and it looks likely that the $1300 level will eventually get broken above, and the market should continue to go much higher. Given enough time, I believe that gold markets finally break out and go much higher, and I am more of a “buy-and-hold” type of traitor, but in the physical sense or at least the non-leveraged sense. The fact that there is a lot of volatility makes the idea of having too much in the way of leverage far too dangerous, so I think that given enough time it’s likely to see both buyers and sellers jumping into the market. Longer-term though, I do think that the US dollar looks vulnerable, and in general gold should rally. By being prudent and more importantly should, you can take advantage of the longer-term proclivity to rally, as we have seen a significant uptrend line hold supportive as well, and therefore we have many different reasons to believe that technically speaking at least, gold looks strong.

Gold Outlook Video 28.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement