Advertisement

Advertisement

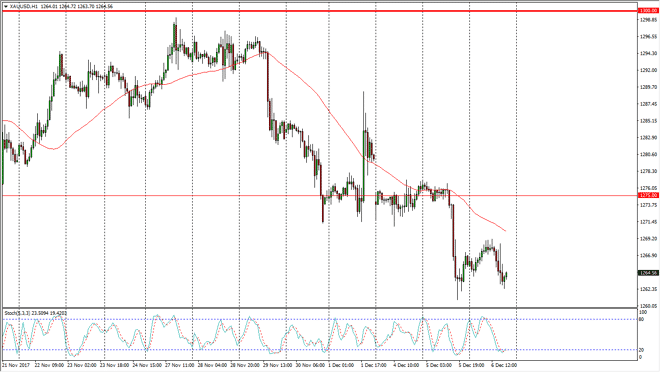

Gold Price Forecast December 7, 2017, Technical Analysis

Updated: Dec 7, 2017, 06:02 GMT+00:00

Gold markets rallied a bit during the trading session on Wednesday, but rolled over again as we continue to look at the $1262 level for support.

Gold markets continue to be very volatile, but continue more than anything else to fall. The $1262 level has offered a bit of support, but I think ultimately, we are going to go down to the $1250 level underneath, which is the middle of the overall consolidation area that gold markets have been in for some time. Because of this, it’s not until we were to break above the $1278 level that I’m comfortable buying gold, and if the US dollar continues to strengthen in general I think we will see more bearish pressure. I also recognize that the $1250 level should be major support, so I don’t think that we are going to break down below there anytime soon.

I look at these dips as a longer-term value proposition, but in the short term I certainly cannot be bothered to buy. Rallies of this point look to be short-term selling opportunities as the volatility continues, but somewhere closer to the $1250 level should be an excellent buying opportunity. Remember, gold markets tend to be the inverse of the US dollar, so pay attention to the US Dollar Index, as when it rises, gold falls, and vice versa. Currently, we are seeing US dollar strength against the Canadian dollar, euro, and British pound. That of course means that gold will struggle when priced in US dollars, but if you have the ability to trade gold in other currencies, that might be an opportunity to make money as well, especially against the Japanese yen. Short-term futures trading to the downside is probably how I will spend the next 24 hours.

Gold Price Forecast Video 07.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement