Advertisement

Advertisement

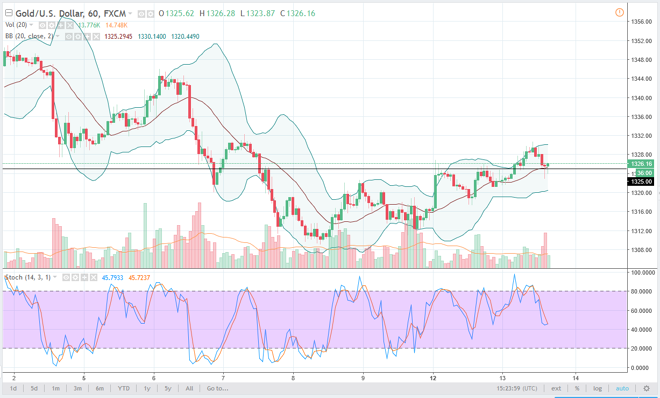

Gold Price Forecast February 14, 2018, Technical Analysis

Updated: Feb 14, 2018, 05:38 GMT+00:00

Gold markets have initially rallied during the trading session on Tuesday, reaching towards the $1330 level above. However, we pull back to retest support that was previous resistance. I think that the market should continue to be bullish though, as the US dollar continues to fall.

Gold markets initially rally during the trading session on Tuesday, rallying all the way to the $1330 level, but then pulled back to retest the $1325 level for support. On the hourly chart, it looks as if we are trying to find that support, and therefore I think buyers will continue to jump into the gold markets as the US dollar sells off. I think that underneath this area, there is likely to be a lot of noise, and more importantly: support.

It looks as if the gold markets are trying to make a longer-term move, perhaps towards the $1350 level, which is massive resistance. I believe that between that level and the $1400 level, there is a lot of noise that will continue to affect the market. If we can ever break above the $1400 level, this market is more than likely going to be a “buy-and-hold” scenario, and that is my longer-term scenario for gold. I do believe that eventually we rally enough to take off to the upside and become more of a “buy-and-hold” scenario.

Because of this, I prefer buying physical gold as well as futures markets, and I think that longer-term we will see plenty of reasons for gold to rally, perhaps geopolitical, perhaps economic, or just plain US dollar weakness. If the US dollar continues to fall overall, that should turbocharge this move to the upside. The correlation between the EUR/USD pair and the gold markets cannot be overstated.

Price of Gold Video 14.02.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement