Advertisement

Advertisement

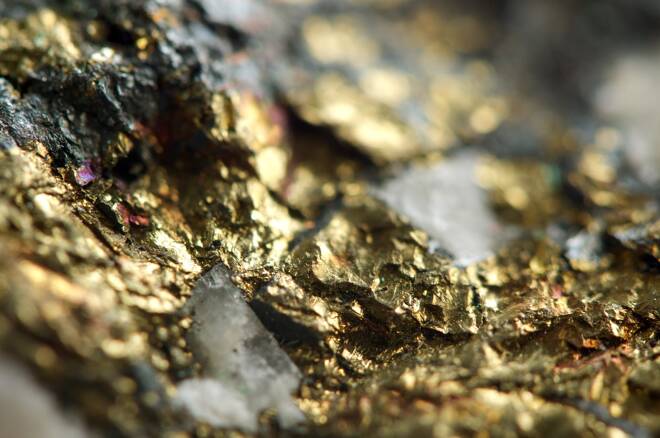

Gold Price Forecast – Gold Markets Continue to Grind Away

Published: Oct 26, 2020, 15:38 GMT+00:00

The gold markets continue to go back and forth during the trading session on Monday, as we are sitting still as we have a ton of risk in both directions.

Gold markets have gone back and forth during the trading session on Monday to show complete confusion as the markets have no idea what to go next. At this point time, the markets continue to see a lot of back-and-forth trading as we just do not know where we are going to go in the sense of where the US dollar is going to end up. Ultimately, this is a market that is held hostage like all of the other ones as we do not know what the election results are going to be and of course there is a ton of risk out there.

Gold Price Predictions Video 27.10.20

At the moment, it looks like we are simply killing time around $1900 between now and the election, as stimulus has most certainly taken a backseat, probably not coming in the United States until at least the beginning of next year. As things get more contentious, it is almost impossible to imagine a scenario where anything gets done anytime soon. Furthermore, the US dollar may continue to pick up strength due to the fact that people are becoming a bit more concerned in general around the global economy and the problems in the European Union. If that does in fact end up being the case, then there is no real reason to be trading anything at this moment.

In fact, I suspect that the next week or so is going to be a lot of choppy back-and-forth trading. From a longer-term perspective I do expect gold to go much higher, but we are very likely to see more of a downward pressure in the short term. The $1850 level would be an area that I think there should be some buying pressure, and beyond that I anticipate there is real demand $1800.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement