Advertisement

Advertisement

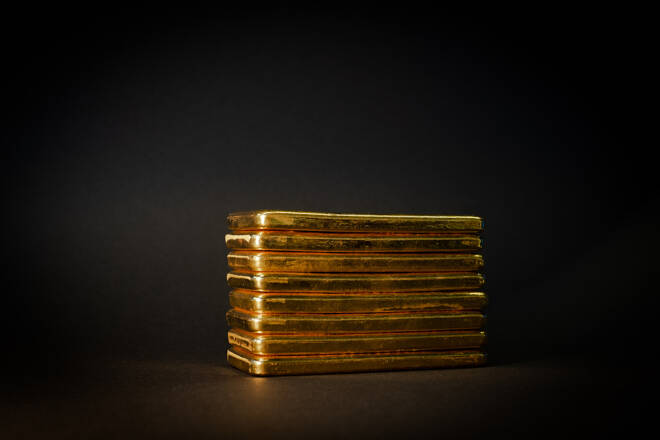

Gold Price Forecast – Gold Markets Have a Quiet Friday

Published: Jul 15, 2022, 15:53 GMT+00:00

Gold markets continue to bounce around the $1700 level, looking very likely to continue with the overall malaise that we have seen.

Gold Market Technical Analysis

Gold markets are hanging about the $1700 level, calming down a bit after the massive selling-off that has been done to this market. I think a short-term bounce does make a certain amount of sense, if for no other reason than the fact that we are overdone. Furthermore, when you look at the longer-term charts, you can see that this area extends all the way down to the $1680 level as a major support level. If we were to break through all that, obviously it would be a major event.

On a breakdown, the market is likely to lose $200 rather quickly. However, I think it’s much more likely that we will bounce from here, perhaps trying to get to the $1750 level before we sell off again. After that, the $1800 level is likely to be targeted, and if we can break above there then it’s likely that we go much higher, perhaps recovering completely.

As things go, you need to pay close attention to the US dollar and the 10 year yield. If they both continue to strengthen, that is going to be bad for gold. On the other hand, if they both start falling, then gold should, at least in theory, rally at that point. As things stand right now, gold has performed miserably in this high interest-rate environment, as one would expect.

Expect a lot of volatility, and keep your position size reasonable as the noise alone could cause major damage to your account. Given enough time, we should see a bit of clarity, but at this point, I think the main take away is that the market is oversold.

Gold Price Predictions Video for 18.07.22

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement